Belief. 'Ecosystem' #6

Your weekly guide on tech news, early stage fundraising and venture capital.

Welcome to another ‘Ecosystem’ newsletter! Thank you for being part of this journey from the very beginning! For access to all monthly events, archive and expert-led workshops become an annual subscriber.

Last week marked a mini achievement that took me years to complete. I had never failed an exam until I started a driving course. The theory test is textbook-straightforward - people with middle school diplomas sit it and get a maximum score. Intelligence of course can not be measured in formal education; my point is it was never a question of complexity. Smarter or not, they were definitely more determined.

I’ve said it before - what you focus on, grows. Getting a driving licence had never been a priority for me. More importantly, perhaps due to a previous traumatic experience, I feared being on the road alone. What if I misinterpret a sign and create a traffic accident? And a lot more less than probable worries.

How does this story relate to startups or venture capital?

One, if you are looking at anything as an option, it will always remain just that. You need to put in the work. And there are no shortcuts to quality learning. In industries that require constant self-improvement, you learn daily. Two, conquer your fear, or it will cripple your chances to success.

"You can't have everything you want, but you can have the things that really matter to you." - Marissa Mayer, Former President and CEO of Yahoo!

“There are no shortcuts to knowledge, especially knowledge gained from personal experience. Following conventional wisdom and relying on shortcuts can be worse than knowing nothing at all.” - Ben Horowitz, Co-Founder, Andreessen Horowitz

#EcosystemGiants events

The next ‘Tuesday Talks’ #EcosystemGiants event is tomorrow, 11 August at 2pm BST. Maren Bannon (Founding Partner, January Ventures) and Yvonne Bajela (Founding Member and Principal, Impact X Capital) will join me to share more on their journeys to venture capital, diversity in investment and using tech to create a fairer world. We’ll also discuss the new tools reshaping how work is done and the latest on the early stage fundraising market in Europe/The US. RSVP here.

If you missed out on the July sessions and are a premium subscriber, you may watch the recording here.

Is there a VC investor/founder you would like to suggest as a future speaker? Email me if you would like to pitch for feedback.

Future #EcosystemGiants talks won’t be on Zoom. See below for more details.

Innovation Ecosystem Updates

Whether you are an investor, a founder, an operator, a corporate or a friend. My top 5 news stories this week which you may find of interest too.

Raising a VC fund with a notion memo and a few tweets(in two months’ time)? It is exactly what Sahil Lavingia(Gumroad founder and CEO) did, raising more than $1M(a quarter) and maxing out the number of subscribers allowed by SEC rules. More on his $5m rolling fund on AngeList via Techcrunch

1/5 of Harvard University first-year class differ enrollment. So far. The story on the hundreds of accepted students who will not be starting school this fall and how the pandemic may forever change higher education via CNN.

The TikTok saga continues. Not just Microsoft, Twitter too is in talks to acquire the U.S. operations of the popular social-media app. The latest on the possible deal via Bloomberg.

*As always, Chetan Puttagunta perfectly captured the latest news, referring to the 2016 Twitter’s failed attempt at short-term video in 2016 (shutting down Vine to save on costs). This new development would be a case study for the ages indeed.

Two of the largest publicly traded companies in digital health, Livongo and Teladoc, came together in less than three months(and against the backdrop of the Coronavirus pandemic!). More about the $18.5 billion merger via CNBC

The bachelor meets Zoom. Silicon Valley’s experiment in entertainment and matchmaking premiered this weekend on Twitch. Is the ‘Zoom Bachelor’ Sheel Mohnot(Better Tomorrow Ventures) the big VC winner of the pandemic? More on the online series(featuring former A16Z partner Li Jin as one of the 12 contestants!) via Forbes

Funder

How do you find product market fit if you do not yet have a product? Ajay Kamat(Partner, Pear VC) shares his advice for “stage 0” founders who are starting from scratch and points to ways to attract enough users to begin measuring.

Are you building an enterprise startup and working on its go-to-market strategy? Check out A16Z’ Peter Lauten(Partner) and Martin Casado(General Partner)’s analysis on “growth+sales” - the bottom-up growth motion layered with top-down sales - and why it will be the dominant attack vector on enterprise incumbents.

How have some companies (Apple, Tesla, Superhuman) risen above competitors by building an army of loyal followers(infused with a great sense of pride and purpose)? Jordan Odinsky(Investor and Head of Platform, Ground Up Ventures) analyzes the making of cult brands and the strategy towards becoming one.

Wonder how emerging fund managers (should) go about portfolio construction? Craig Thomas (Managing Director, Verger Capital) explores building a venture fund model in detail and why it functions as a guide and a point of discussion with potential LPs.

Founder

Using social media to accelerate startup and personal success? Gefen Skolnick (Founder, Couplet Coffee) on using Twitter to raise money for angel investments, build a brand and a strong network.

How well do your colleagues/employees understand what makes you tick and what ticks you off ? Former Product Design VP at Facebook Julie Zhuo (and currently Co-Founder, Inspirit!) on writing a “How to work with Julie” guide for her team and why ‘A User Guide for a Person’ is a a tool that can improve the internal communication and increase workers’ productivity.

A crucial part of investors’ core psychology is how they think about zeroes(or assess risk). Are they more oriented towards maximizing upside, or minimizing downside? David Cummings(Founder, Atlanta Tech Village) sheds light on the concept of zero loss ratio.

Twitter Highlight(s)

Finn Murphy, Principal, Frontline Ventures

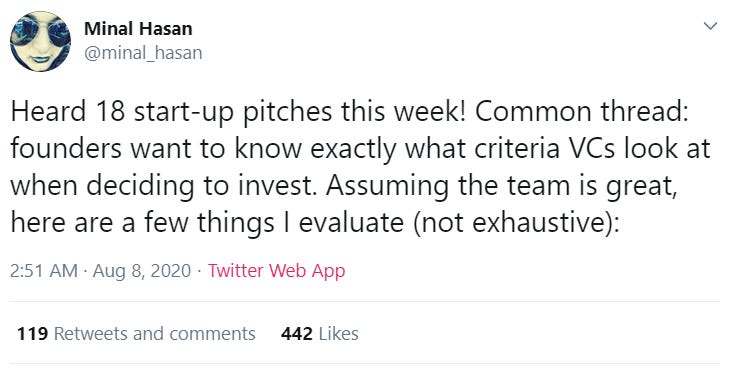

Minal Hasan, Founder and General Partner, K2 Global

Startup of the week

Chalk, a voice-based social network where users can connect and socially learn in real time. The app empowers content creators to turn their audience into a (voice) community.

Future #EcosystemGiants talks will be on Chalk, join the Ecosystem community here for the latest updates.

Tweet @chalk_app and @Juyan_Azhang to let them know they’ve been featured in ‘Ecosystem’!

Startup Go-to Resources

Fundraising in a Pandemic World : Words of wisdom by Semil Shah, founder of Haystack Ventures and Venture Partner at Lightspeed Venture Partners.

A Decade of Learnings from Y Combinator Cap Tables

The best of a16z's podcast featurin Marc Andreessen

*I very much recommend the episode on talent, tech trends, culture.

B2B Selling in COVID-19 : 16 key questions to help you sell and survive; a guide by the investment team at a16z

The ultimate guide to Startup Metrics : What to track, when and why - a must read by Speedinvest Pirates(the growth marketing unit of Speedinvest!)

The All Raise Summer 2020 Reading List : A selection of the favorite books by 26 exceptional funders, founders and operators

20:VC with Joe Thomas (Founder and CEO, Loom) on how early stage founders should select their investorsThank you for being part of the second ‘Ecosystem’ newsletter!