Reflection.'Ecosystem' #12

Your weekly guide on tech news, early stage fundraising and venture capital.

Welcome to another ‘Ecosystem’ newsletter! Thank you for being part of this journey from the very beginning! For access to all monthly events, archive and expert-led workshops become an annual subscriber.

If you are a regular ‘Ecosystem’ reader, you know the intro part is the least structured one. It takes me the most time to write. I try to make it somewhat educational in each edition. Yet certain themes come up more often than others - the importance of focus, the need to learn how to delegate/prioritize (you should read ‘The CEO of No’ article below!) the and the power of being kind.

“The greatest productivity tool ever invented is the ability to say no” - Shane Parrish, Founder, Farnam Street

On being kind - What you project, you attract (yes I did add a Buddha quote!).

It is true. If you think this may be far from venture, see how many investors list Paulo Coelho’s The Alchemist as one of their favourite books(hint hint - this type of detail you could bring up if reaching out cold!). It is possibly why the new generation of VCs increasingly come from a new set of majors with a skillset invaluable in human assessment (at an early stage A LOT is decided on the founder). Philosophy, psychology, anthropology or even politics majors (Sarah Tavel, Benchmark; Gaby Goldberg, Chapter One; my colleague Siobhan Brewster, Amplifier and even now myself) that help understand the micro and macro factors beyond the business, like the environment it operates in and the drivers of an entrepreneur. Being able to understand others ultimately starts with having clarity about one self. Do you agree?

“For every action there is an equal and opposite reaction. You receive from the world what you give to the world.”

― Gary Zukav, The Seat of the Soul**

Ecosystem Events

It was a real pleasure having Esha Vatsa (Principal, Pi Labs) as a guest speaker in last week’s #EcosystemGiants session. We spoke about innovating in a traditional industry, what investors look for in early stage startups and succeeding as a woman in proptech/venture capital. Watch the recording here.

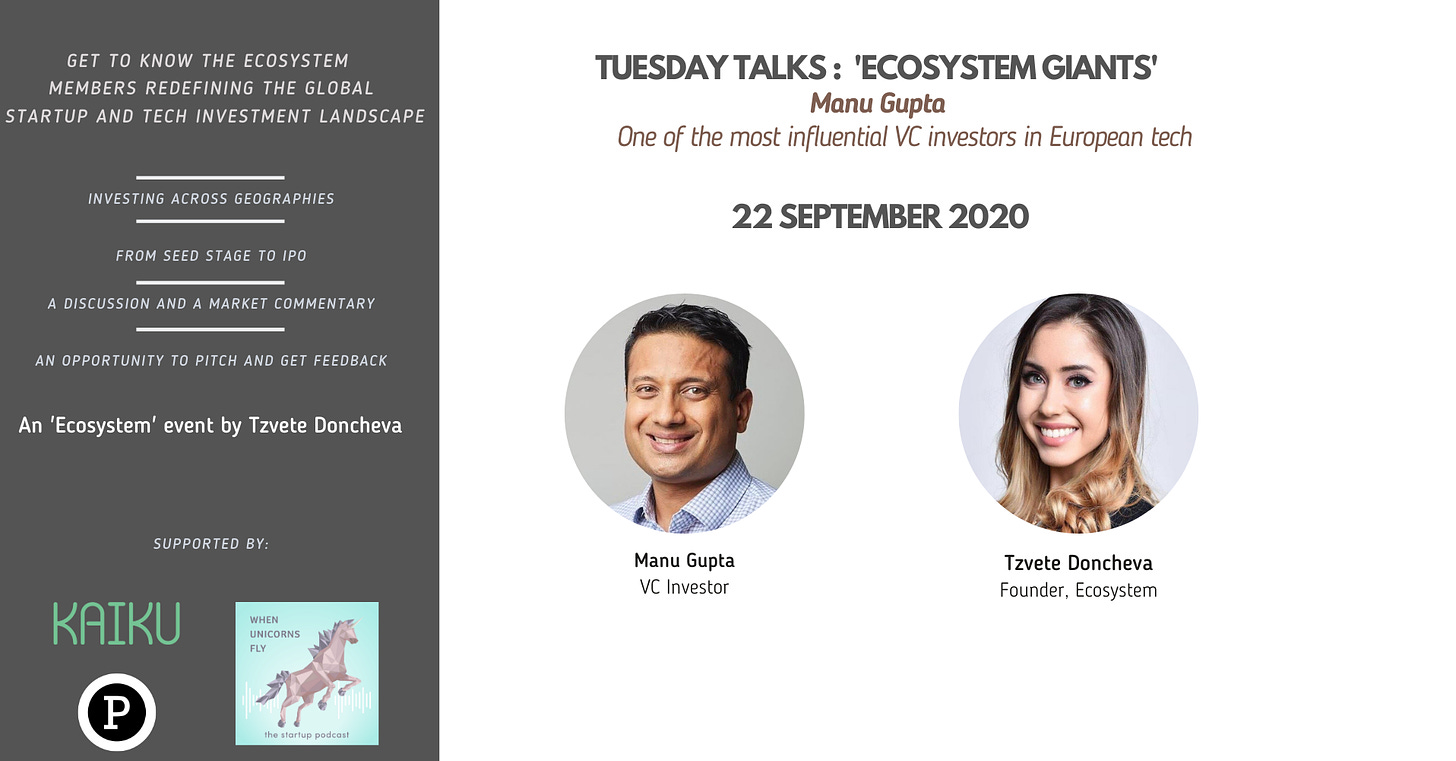

Tune in tomorrow, 22 September 2020 to hear from Manu Gupta, one of the most influential venture capitalists, investing in European tech. He was previously a founding team member and Partner of Lakestar, helping raise $1.4bn in 6 years to become one of Europe’s largest tech venture funds. In his first public talk since his departure, Manu will share how he built his career in venture, his investment criteria, assessing deals and lessons learned from partnering up with some of world’s most talented entrepreneurs. Join the conversation at 5pm BST - RSVP here.

Supported by Kaiku, When Unicorns Fly and ParlayMe

Innovation Ecosystem Updates

Whether you are an investor, a founder, an operator, a corporate or a friend. My top (about) 5 news stories this week that you may find of interest too.

As a follow-up from last week’s Ecosystem newsletter - on 15 September 2020, Opendoor, the largest instant home buying platform in the US, announced it is going public through a $4.8m SPAC merger with Social Capital Hedosophia(Forbes). 3 days later, on Friday 18 September 2020, Chamath Palihapitiya(Founder, Social Capital) filed 3 NEW SPAC vehicles(blank checks to take private companies onto the public markets) via CNBC. Techcrunch’s title says it all

A wave of German acquisitions. Berlin-based sennder acquired Uber’s European freight business in an all-stock transaction (Sifted) and Delivery Hero bought fellow third-party delivery service Glovo’s Latin American operations for €230 million(The Spoon)

Angel investors Justin Kan and Robin Chan (early backers of Uber, Bird, Square) launched a new hybrid incubator fund, Goat Capital (an animal they believe exemplifies the qualities of good founders!). With a target $40m raise, they’ll be partnering with early stage founders in the areas from digital healthcare to climate change (think impact!)

Glassdoor for VCs. Forbes asks if this is a ‘burn book’ in disguise. Who is the investor that would get your positive review?

Supreme Court’s feminist icon, Ruth Bader Ginsburg, passed away at age 87 - her story via The New York Times. Watch the remake of her incredible life, the inspiration behind the movie ‘On the basis of sex’.

Laura Connell, Principal, Balderton Capital

Funder

How can a startup successfully navigate any storm? Ophelia Brown (Founder and Partner, Blossom Capital) explains the importance of sound fundamentals and shares six criteria for investing in ‘recession proof’ companies

If VCs could predict the future, why wouldn’t they just start companies themselves? Hussein Kanji (Founding Partner, Hoxton Ventures) on spotting future unicorns, the challenges startups creating (or entering) new markets face and the new responsibilities tech giants need to take. If you missed him on ‘Ecosystem Giants’, watch the recording here.

What helps Marc Andreessen (Cofounder and General Partner,Andreessen Horowitz) stay motivated and keep on the right track? He shares how his ‘guide to productivity’ has evolved (a shift to a more structured way of living!), why ‘open time’ is important and more on the value of delegation

How do open source startups grow from free projects into billion-dollar companies?Glenn Solomon (Managing Partner, GGV Capital) on monetizing open source, getting the business model right and the two main approaches to generating revenue

Founder/Operator

The CEO of No with a thriving collection of over 30 companies with about 600 employees collectively. Or how Andrew Wilkinson (Managing Partner, Tiny Capital) turns emails/people into opportunities by declining anything that doesn’t fit into his vision of success(think templates with a hundred different polite ways to say “No”!). An interview by Dan Shipper(Former,Co-Founder Firefly) and Kieran O’Hare.

And another interview. Sari Azout(Head of Strategy, Rokk3r Labs; Venture Partner, Level Ventures and Former Co-Founder, Bib + Tuck) on the differences between angel/institutional investing, the challenges faced along the way and what makes a good investment (don't confuse a good product with a good business!). Written by Angela Santurbano(Product Manager, Facebook and angel investor).

Everyone’s been talking about .. Roam, whose most recent $9m raise was at about 25 times the median valuation for seed rounds (it’s also a 200x multiple of their most recent publicly shared ARR of $1m!). Nathan Baschez (former VP Product, Substack) looks into how the note-taking app can grow into its $200m valuation and why it should become more like a network — and less like a to do list.

Twitter highlight(s)

Elizabeth Yin, Co-Founder and General Partner, Hustle Fund

Anonymous Startup CEO(?)

Startup of the week

Kinetix, a web platform enabling creators to turn any video into a 3D animation. The AI SaaS tool automates 80% of the manual work involved in animation. Obviously outside of the mandate of the fund I am currently working at, but nevertheless an interesting company to watch!

What startup should I feature next?*

*I would love to hear from audio-first/voice tech companies(especially B2B). If you are building something in the space, reach out!

Startup Go-to Resources

B2B Selling in COVID-19 : 16 key questions to help you sell and survive; a guide by the investment team at a16z

Sonali De Rycker(General Partner,Accel) on Seedcamp's This Much I Know - on grit, ambition and supporting founders through lows and highs. Easily one of the best podcasts I've listened to in a while.

What You Do Is Who You Are: How to Create Your Business Culture by A16Z's Ben Horowitz."Because your culture is how your company makes decisions when you're not there."

The Hard Thing About Hard Things - yet another absolute gem by Ben Horowitz. Reflections from his time as an entrepreneur(who prior to setting up A16Z sold his company Opsware to Hewlett-Packard for $1.6 billion in cash!), making decisions when there are no good available options and internal/external business communication.

Advice on how to get advice - how founders can maximize the expertise of advisors they’ve already assembled; insights summarised by First Round Capital.**The book I randomly picked up prior to my birthday this week. I recommend it!

Thank you for being part of another ‘Ecosystem’ newsletter!