Empowerment.'Ecosystem' #19

Your weekly guide on tech news and early stage fundraising. Democratising access to venture capital for underestimated founders and investors.

Welcome to the ‘Ecosystem’ newsletter! For access to all monthly events, archive or if you would like to support the project, become an annual subscriber.

Hello and welcome to issue #19!

History was made last week! The election of the first female Vice President Kamala Harris of world’s largest democracy is of huge significance to women globally. A real-life example, showing young girls everywhere glass ceilings can and must be shattered. 👏

It was very humbling to be able to speak with Oliver Holle (Co-Founder and Managing Partner, Speedinvest) at #EcosystemGiants and find out more about his journey as an entrepreneur, raising a micro venture fund and growing it to be one of the leading early stage VC firms in Europe. Key lessons shared:

Pick your early investors very carefully - check references and look for the VCs who can also help you with the next round.

Great people form great teams around them - recognise and empower your top performers.

Speed of iteration matters in success - amazing people are very fast to move things forward and very fast to come up with ways to solve problems. And a way to address homogeneity is to show success can be achieved by driving results differently.

What did Oliver learn in the transition from an entrepreneur to becoming one of Europe’s most successful VC investors?

"The importance of building truthful, honest relationships within one’s firm and externally." - Oliver Holle, Co-Founder and Managing Partner, Speedinvest

EcosystemGiants Events

There is no #EcosystemGiants event next week. The aim of both this newsletter and the sessions hosted(or ‘Ecosystem’ as a project) is to have a positive impact on democratizing access to the venture industry for less networked founders and junior VC. On that note, I am very excited to share the below initiative I’m part of. We all know the venture industry is not short of data. Women are underinvested in and despite various activities within the broader ecosystem, there has been little to no movement in the amount of VC funding going to women-led businesses since 2012*.

To tackle this problem effectively, we need to review the practices in the VC investment process from the very beginning. As near the end of one of the most disorienting years and Europe enters a second lockdown, we at Amplifier and three of the continent’s top early stage funds - Speedinvest, La Famiglia and Redstone - come together to dig into a big problem with no straight answer - 'Is the VC pitch process failing female entrepreneurs?'

Join us next at 4pm CET Wednesday, 18 November 2020 as we explore where we might be going wrong and how female entrepreneurs can improve their chances of success when pitching to VCs.

Innovation Ecosystem Updates

Whether you are an investor, a founder, an operator, a corporate or a friend. The top news stories this week you may find of interest.

Trending. Is Spotify launching a subscription podcast plan? (The Verge). Uber and Lyft drivers are to remain contractors as 58% of Californian voters voted in favor of Proposition 22 (TNW). Meanwhile, The exodus from San Francisco continues. Why is Palantir co-founder Joe Lonsdale leaving Silicon Valley? (CNBC). In Europe, Mercedes withdraws from the autonomous driving race (Motor1), while in the US Lilium may soon be bringing *driverless* flying taxis to the Florida horizon (Interesting Engineering).

New funds. All Iron Ventures launches Spain’s biggest debut fund(€66.5m) with no public money (Sifted). UBS sets aside a $200 million fund for investing in fintech startups (Pitchbook). Across the pond, in the midst of a polarizing election, capital for new VC funds continues to flow. Hustle Fund, built by former operators and founders, raised a new $30 million fund to invest in pre-seed (E27). Precursor Ventures(backer of mmhmm), closed $29 million of a target $40 million fund and after securing a $9.5 billion fund in April 2020, Insight Partners raised a new $413 million for its first-ever Opportunity Fund. (Techcrunch).

Women wins. 2019 Set a Record for New Female-Led Unicorns - an increase by 7x since 2013 (Business Insider). And more women than ever before elected to Congress (CNBC).

Big rounds. Toyota-backed autonomous vehicle startup Pony.ai raises $267 million in latest fundraising (Reuters). Events startup Hopin becomes a double unicorn, raising $125m SeriesB (at a valuation of over $2.1billion) 8 months after launch (Techcrunch). Logistics startup Outrider closes a $65 million round to make warehouses and distribution centers autonomous (VentureBeat). Faire, the online wholesale marketplace connecting more than 100,000 local retailers and 10,000 brands closes a $170 million Series E round led by Sequoia Capital in a $2.5 billion valuation (Forbes).

Funder

If infrastructure is the future of fintech, what makes a great infrastructure business? Matt Ford (Partner, Mouro Capital) talks about the features that make portfolio company DriveWealth stand out in the broader context of embedded finance platforms and how to prevent customers churching when they reach scale

The market you choose to serve is one of the most important factors for an early-stage startup. For your market, the two key things to understand are (a) how many potential customers are there and (b) how much will each of them be worth to you if everything goes right. The better you really understand those details and can go deep on them, the more successful both your pitch and your business will be.

Mike Vernal (Partner, Sequoia) on market sizing and how to prepare to address the frequently asked questions for dissecting this during pitches

Elizabeth Yin (Co-Founder and General Partner, Hustle Fund) addresses the myths of follow-on investing founders and investors face

Founder/Operator

Fundraising is a full-time job and mastering the art of (cold) email outreach is critical to success. Yuliya Bel (Founder, Notus) summarizes key pointers on increasing the odds of getting an investor meeting and shares a no-warm-intro-required list of VCs

Is there an open Banking (r)evolution in Central and Eastern Europe? A comprehensive analysis on the current/future trends and the local players to watch featuring insiders views by (Alexandra Kozbunarova and Etien Yovchev, Trending Topics)

Jason Citron (Founder and CEO, Discord) on building one of the largest and fastest growing social networks in the world (with over 100m users!), creating a third place for people to congregate and his top hiring tips. A conversation with Patrick O’Shaughnessy(Founder, Invest Like the Best).

Twitter Highlight

Simon Menashy, Partner, MMC Ventures

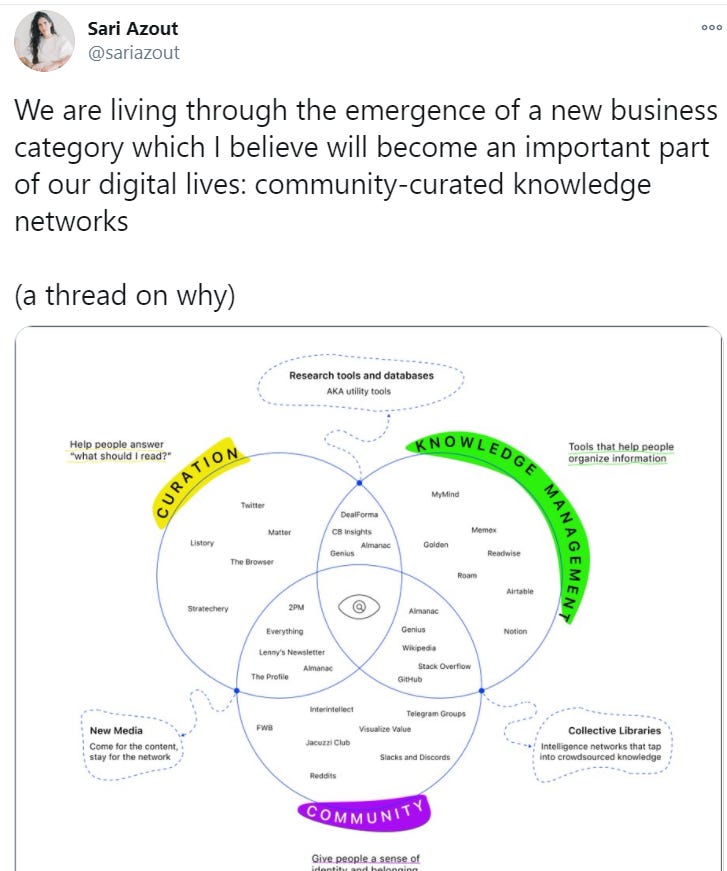

Sari Azout, Partner, Level Ventures

Startup of the week

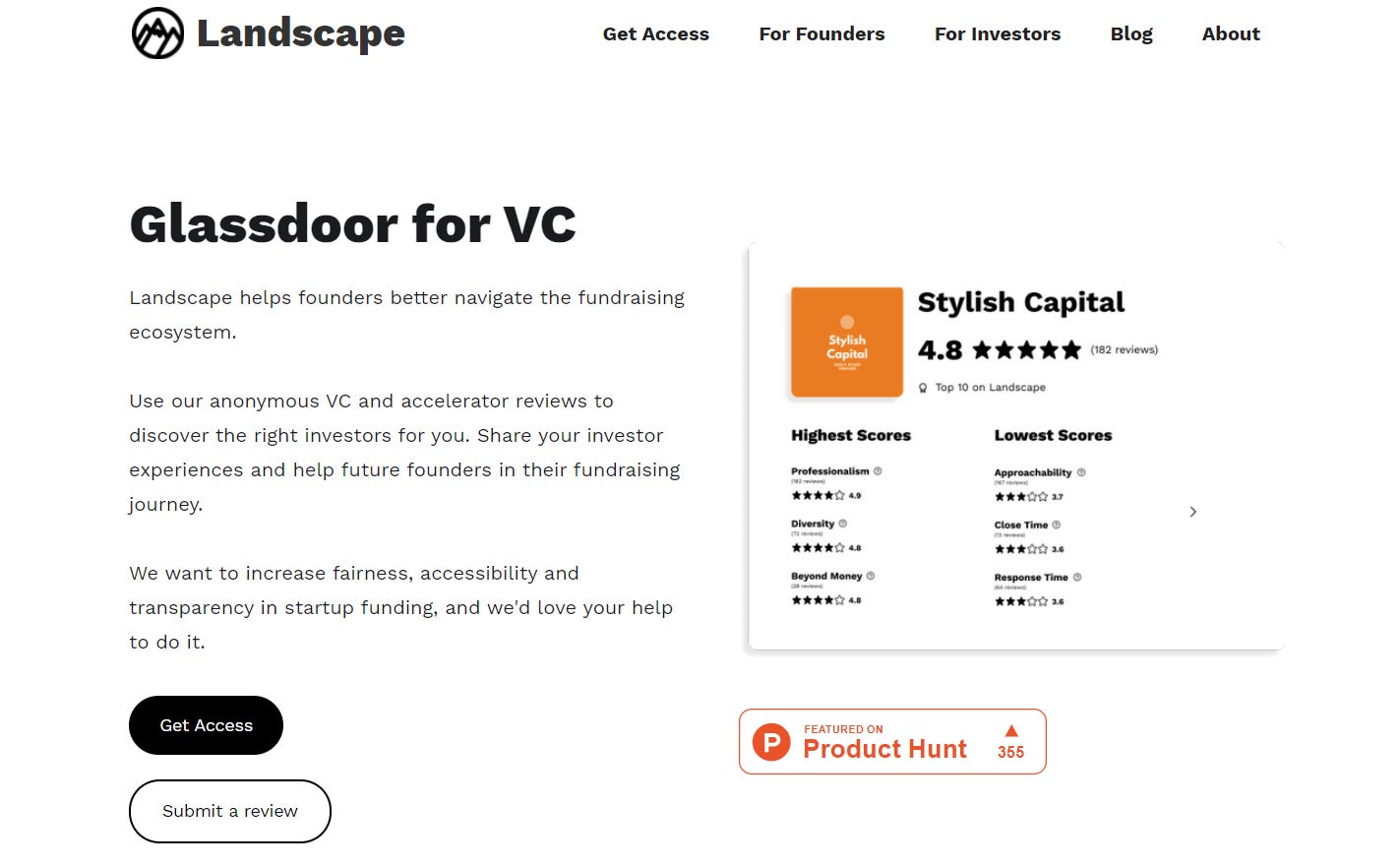

The ‘Glassdoor for VC’

Lanscape, a review platform for tech startup founders to discover investment opportunities and rate venture capitalists. It’s not exactly news I find very few people have heard about it still.

Tweet @Landscape_vc to share they were featured in ‘Ecosystem’!

In my current day-to-day role, I look at supply chain tech. Now specifically focusing on solutions to measure/reduce/quantify carbon footprint. What are the startups working at the intersection of supply chain and sustainability I should know about?

Startup Go-to Resources

The bi-annual Marketplace Conference December 1st and 2nd 2020 - an online and global edition! Join for keynote sessions, panel discussions and networking covering everything marketplaces: from design, strategy, growth hacking to fundraising. Organised by Autotech Ventures, Battery Ventures and Speedinvest x

Sequoia Partner Roelof Botha on evaluating founders/markets, empathy and vulnerability in venture(20VC) - "He who has a why to live can bear almost any how."

Future Now (FTRNW) is a platform focused on building an innovative ecosystem across CEE linking early stage startups with key investors and industry players. Now running a fully digital bootcamp from 23 November – 11 December 2020 where selected startups will get advice from the best mentors, partners and VCs in the region. Apply here by 6 November 2020.

Y Combinator's Guide to Seed Fundraising - from why and when to raise money to what not to do while communicating with investors

The B2B SaaS Pricing Masterclass - how subscription software companies price, package, and position their productsFounder Narrative Fit - what is it, how investors detect it and why they invest in it.

No-warm-intro-required investor list - a spreadsheet with contact details of VCs you can strategically reach out to cold.

CEO and Co-Founder of AngelList Naval Ravikant's AMA is a must read - value-add tips to succeed in business and life