Humbleness.'Ecosystem' #13

Your weekly guide on tech news, early stage fundraising and venture capital.

Welcome to another ‘Ecosystem’ newsletter! Thank you for being part of this journey from the very beginning! For access to all monthly events, archive and expert-led workshops become an annual subscriber.

In such a fast-paced world, one of the worst things you can do is staying still. Knowledge is all around us and thanks to technology, resources of immense value are at an arms’ length. Are you actively upskilling yourself? And if not, what is stopping you?

As a former reporter, I enjoy speaking with people of all walks of life - what drives them do what they do and how they got there. Most recently, my focus has been on venture capital - not only because it is (has become) the industry I work in, but because of the incredible importance of venture financing in today’s world. It is an engine of economic growth that fuels both innovation and job creation (think how many of the largest companies employing thousands of people are VC-backed, tech businesses).

Sometimes, I am lucky enough to be able to speak with the people who spotted these billion-dollar businesses and believed in the founders’ vision early on. One such person is VC investor Manu Gupta, who led the investments or sits on the board of Casafari, Builder.ai, Opendoor, SoFI, Figure, Maker Studios(to name a few!) as well as assisting in over a dozen other exits. He was peviously a founding team member and Partner of Lakestar, helping raise $1.4bn in 6 years to become one of Europe’s largest tech venture funds. He joined me as a guest speaker at last week’s #EcosystemGiants session and shared key points founders should note like:

Speak to as many investors as possible to find the right one to build a long-lasting partnership. Do your research, know who to approach and who could add the most value to your business (especially if going after a very specific thesis/sector).

Work on being able to clearly communicate your vision – essential not only for raising investment, but for attracting motivated, good people as employees who can help you achieve this vission.

My biggest takeaway from our chat? How humble Manu was. A skill we could all work on becoming better at. The recording is available (for free) on demand this week - message me for details.

“Learn by observing. When to use what tool in your tool shed is one of the most important things that you learn from people that have done it before.” - Manu Gupta, VC investor

#EcosystemGiants Events

In September, two incredible VC investors took part in #EcosystemGiants.

The discussion with Esha Vatsa (Principal, Pi Labs) was on raising a seed round, innovating in an industry resistant to change and succeeding as a woman in venture capital/proptech.

Last week, one of the most influential investors in European tech, Manu Gupta and I spoke about assessing future billion-dollar businesses, building a long-lasting career in venture and supporting companies from seed to IPO.

Links to the September, August and July recordings.

Innovation Ecosystem Updates

Whether you are an investor, a founder, an operator, a corporate or a friend. My top (about) 5 news stories this week that you may find of interest too.

The week in (new) funds. London-based Kindred Capital raised a $105 million second fund (interesting to note its portfolio founders get carry in the fund and 38% of top of funnel deal flow is sourced by entrepreneurs!) via Business Insider. Out of Berlin, Point Nine (backer of European giants like Delivery Hero and Revolut) closed a fifth fund at €99,999,999.99 (the team loves the number nine!) via Sifted. Across the pond, former Co-founder of Initialized Capital and Reddit, Alexis Ohanian files for a new $150 million fund just three months after leaving Initialized (first reported in ‘Ecosystem’ back in August!) via Techcrunch

And more capital for exceptional founders. Spotify CEO Daniel Ek pledges to invest $1 billion of his personal wealth in European moonshots (Protocol)

IPO Market Parties Like It’s 1999 (The Wall Street Journal).

“Even in midst of a recession, investors pour money into newly public companies on part with the dot-com era”.

Used-clothing platform Poshmark files to go public (Bloomberg). ByteDance announces IPO for TikTok Global(DW). After the delivery spike, Amazon-backed Deliveroo in talks to launch a 2021 IPO(MarketWatch).

United Airlines to be the first U.S. carrier to offer customers coronavirus tests (The Washington Post). A negative result will allow for the otherwise mandatory 14-day quarantine (the pilot runs San Fran-Hawaii) to be skipped.

London pledged to become net-zero carbon by 2050. What does it mean in practice and how will a city expected to house more than 11 million people (in 30 years) achieve this? (BBC)

Funder

Are you a founder looking to enter the US market? Index Ventures’ #DestinationUSA is THE guide for European founders expanding to the US; featuring:

Insight and analysis from 353 European startups

Founder interviews and 18 case studies

ExpansionPlan app to identify best expansion strategy

The level of content and execution is beyond impressive - browse through it here.

From building an enduring mass-market business to hiring and product execution - Sarah Tavel(General Partner, Benchmark) compiles an extensive summary of the (super useful!) guides she’s written to date.

Will a ‘media company of one’ become the new standard in VC? Marvin Liao (Former Partner, 500 Startups and angel investor) writes about the importance of personal brand in venture capital.

In consumer technology, everything old is new again. Gaby Goldberg(Investment Associate, Chapter One) explores modern alternatives to legacy products and the growing trend in the comeback of the command line (and what it is!).

On the horizon - Eastern Europe. Oskar Stachowiak(Managing Partner, The Untitled Ventures) highlights why VCs should take a deeper look into the continent’s under explored region.

Founder/Operator

What does the richest person on Earth, founder and CEO of Amazon, Jeff Bezos look for in job candidates? As summarised by Judith Humphrey(Founder of The Humphrey Group) for Fast Company.

The face of media is changing. Chris Best (Co-founder and CEO, Substack) on monetising a freemium b2c model and attracting 250,000 paying subscribers on the writer network.

Code is the language of the modern world. Why should you need a translator? Elizabeth Tweedale (CEO, Cypher) on why learning to program is a vital skill and how teaching kids to code will help them to be future-ready. *Freelance coder Kristina Arezina shares how she self-taught herself how to program at 16.

Twitter highlight(s)

Frank Rotman, Founding Partner, QED Investors

Ari Helgason, Principal, Index Ventures

Startup of the week

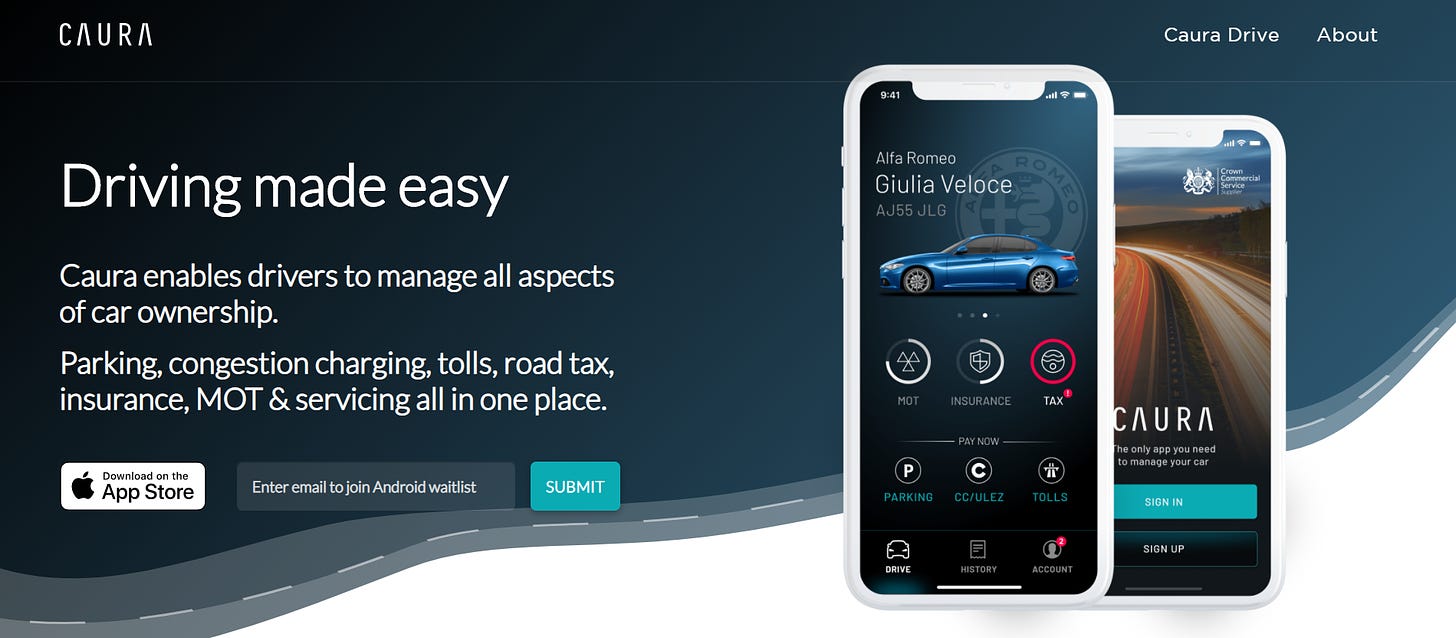

Caura, an app that takes out the hassle of car ownership by minimising all related admin and helping to mitigate associated penalty fines. The payment platform for your car to manage parking, tolls, congestion charge, MOTs, vehicle tax and insurance is also one of the 31 companies selected to be part of TechNation’s fintech programme.

Follow @caura (and founders @dr_laksai, @BhavinKotecha20) and tweet me suggestions for companies I should feature next.

Startup Go-to Resources

Sonali De Rycker(General Partner,Accel) on Seedcamp's This Much I Know - on grit, ambition and supporting founders through lows and highs. Easily one of the best podcasts I've listened to in a while.

What You Do Is Who You Are: How to Create Your Business Culture by A16Z's Ben Horowitz."Because your culture is how your company makes decisions when you're not there."

Techstars Entrepreneur’s Toolkit: online resources to help you learn the fundamentals of entrepreneurship and accelerate startup success

Advice on how to get advice - how founders can maximize the expertise of advisors they’ve already assembled; insights summarised by First Round Capital.

Have you hired a broker to help with your fundraise? Chris Smith (Managing Partner, Playfair Capital) lists the top ten ways brokers can jeopardize your early-stage funding round.

Austen Allred (Founder and CEO, Lambda School) on 20VC - from sleeping in his car to building a company worth well beyond $150m, scaling in public (and across continents) and relocating outside of the Valley. A great episode to listen to!Thank you for being part of another ‘Ecosystem’ newsletter!