Outliers. 'Ecosystem' #17

Your weekly guide on tech news, early stage fundraising and venture capital.

Welcome to the ‘Ecosystem’ newsletter! For access to all monthly events, archive or if you would like to support the project, become an annual subscriber.

Hello and welcome to issue #17!

What are the qualities that make someone extraordinary? While each leader is different and there is no single formula for success, the most successful people share much of the same DNA in the traits that helped them get and stay ahead. High energy, rigorous focus, empathy, the ability to mitigate and manage conflict.

Beyond this, with every ‘Ecosystem Giants’ conversation (the name is spot-on accurate!), I notice an overlooked pattern - the importance of humility in leadership and lifelong learning.

It was incredible to hear from Jean-Marc Patouillaud, Managing Partner at Partech last week. Key lessons mentioned:

Reflecting back on past deals, VCs fail more often because they’ve bet too early, rather than too late. Watch out for the weak signals and be mindful of being blinded by external factors when forging conviction.

When evaluating new markets, take into account structural versus conjunctural changes.

When structuring a board, keep it small to be able to reach consensus with the speed required for a startup to move.

And finally, as cliché as it sounds - if you are in a position of power, use it to drive (or be), the change you would like to see in the world.

“In the current VC world, not enough chance is given to the outlier. You have to give a chance to the outlier.” - Jean-Marc Patouillaud, Managing Partner, Partech

EcosystemGiants Events

I am incredibly excited to welcome Oliver Holle (Managing Partner, Speedinvest) in the next #EcosystemGiants talks session on Tuesday, November 3 at 5pm GMT (6pm CET).

A conversation on launching a micro fund and turning it into one of the leading European early stage venture capital firms (Speedinvest now has more than €400M AUM, +150 portfolio companies, six offices in Europe and San Francisco). Oliver will also share the lessons learned from a successful startup exit and growing as a leader. RSVP here.

Supported by Kaiku, ParlayMe and Startups Magazine.

Links to the September, August and July recordings.

*Want to hear from other members of the Speedinvest team? Check the ‘Startup Go-To Resources’ section below for details for the bi-annual Marketplace Conference.

Innovation Ecosystem Updates

Whether you are an investor, a founder, an operator, a corporate or a friend. The top news stories this week you may find of interest.

New Funds. 212, an Istanbul-based venture capital firm raised a €49 million second fund to invest in startups across Turkey, CEE, and the MENA region (Tech.Eu). German early-stage venture capital UVC Partners with a new €150 million fund to back European B2B mobility, software and industrial tech companies (EU-Startups). Corporate activity across the pond. RA Capital Management, closed a second VC fund of $461 million to invest in private biotechs (Fierce Biotech). T-Mobile launches a VC fund to invest in startups building 5G tech products and services(VentureBeat). And all the way from Bengaluru, 18-year-old VC firm SAIF Partners rebranded Elevation Capital and bagged a seventh $400 million fund to back South-Asian startups (LiveMint).

Trending. Microsoft partners with SpaceX, taking cloud battle with Amazon into orbit (CNBC). Facebook Dating launches in Europe after a 9-month delay over privacy concerns (Business Insider). One of the shortest-lived streaming services to date? Raising $1.8 billion and barely six months after going live, Quibi is shutting down (The Wall Street Journal). Say hello to the No Code Generation (Techcrunch).

Diversity wins. The long-awaited turning point for the VC industry and beyond? Yale lets institutional investors know diversity has now moved front and center (Techcrunch). The number of female-led VC funds has nearly quadrupled over the last five years (Fast Company).

While the industry numbers continue to be grim(only 5.6% of all VC firms in the US being women led), female investors are foregoing the traditional path and building their own VC firms from the ground up.👏

Female founders in the field of Fintech, Insurtech & Proptech? Apply to take part in the next VCs for #FemaleFounders initiative(Office Hours) by 1 November 2013 here: http://apx.berlin/join. The virtual office hours for DACH teams will take place on November 13 2020. At Amplifier we are particularly interested in Trade Finance applications :)

Covid and the coming winter. Berlin’s Tegel Airport closes for good (CNN). UK high street loses 1,000 more jobs; 400 of them cut by Pret a Manger (Guardian). Experts warn of a mental health pandemic as fears for COVID-induced anxiety turning into depression rise (CTV news). Worried about indoor restaurant dining? The real risk is to staff (Eater).

Funder

Onboarding is the experience between “signing up and becoming an engaged user.” To put it simply, if users don’t understand your product, they won’t use it.

Gaby Goldberg (Investor, Bessemer Venture Partners) digs into the consumer onboarding experience — what it is, why it matters, and how you can create a successful onboarding for your own product

On average less than 20% of European startups raise a follow on institutional round post seed. Peter Specht (Principal, Creandum) looks into the strategies to get from seed to Series A

Is there a lack of diversity in fundraising? Reflections and suggestions for a more inclusive venture industry from female investors including Maren Bannon (Founding Partner, January Ventures), Beatrice Aliprandi (Principal, Talis Capital), us at Amplifier and more.

If the future belongs to our youth, what are the trends VCs born ’95 or later are watching? Meagan Loyst (Investor, Lerer Hippeau) on Gen Z investing in Gen Z - favorite companies, unexplored areas and new opportunities.

Founder/Operator

The term building in public is hot right now, but back then I called it “bootstrapping and looking for other builders like me.”

Janine Sickmeyer (Founder, NextChapter; acquired by Fastcase) on building a web app without a technical background and openly sharing every milestone hit online

What is it like to work for one of world’s biggest e-commerce platforms? Alex Danco (Systems & Crypto, Shopify) shares six lessons(insights partnerships, learning as a skill) from his first six months at Shopify

How to avoid burnout by working less and doing more? Ethan Brooks (Senior Analyst, The Hustle) on leveraging priorities, positive constraints and the long-term depression

Twitter Highlight(s)

Nir Eyal, Angel investor and bestselling author of "Hooked" and "Indistractable"

Evgenia Plotnikova, Partner, Dawn Capital

Startup of the week

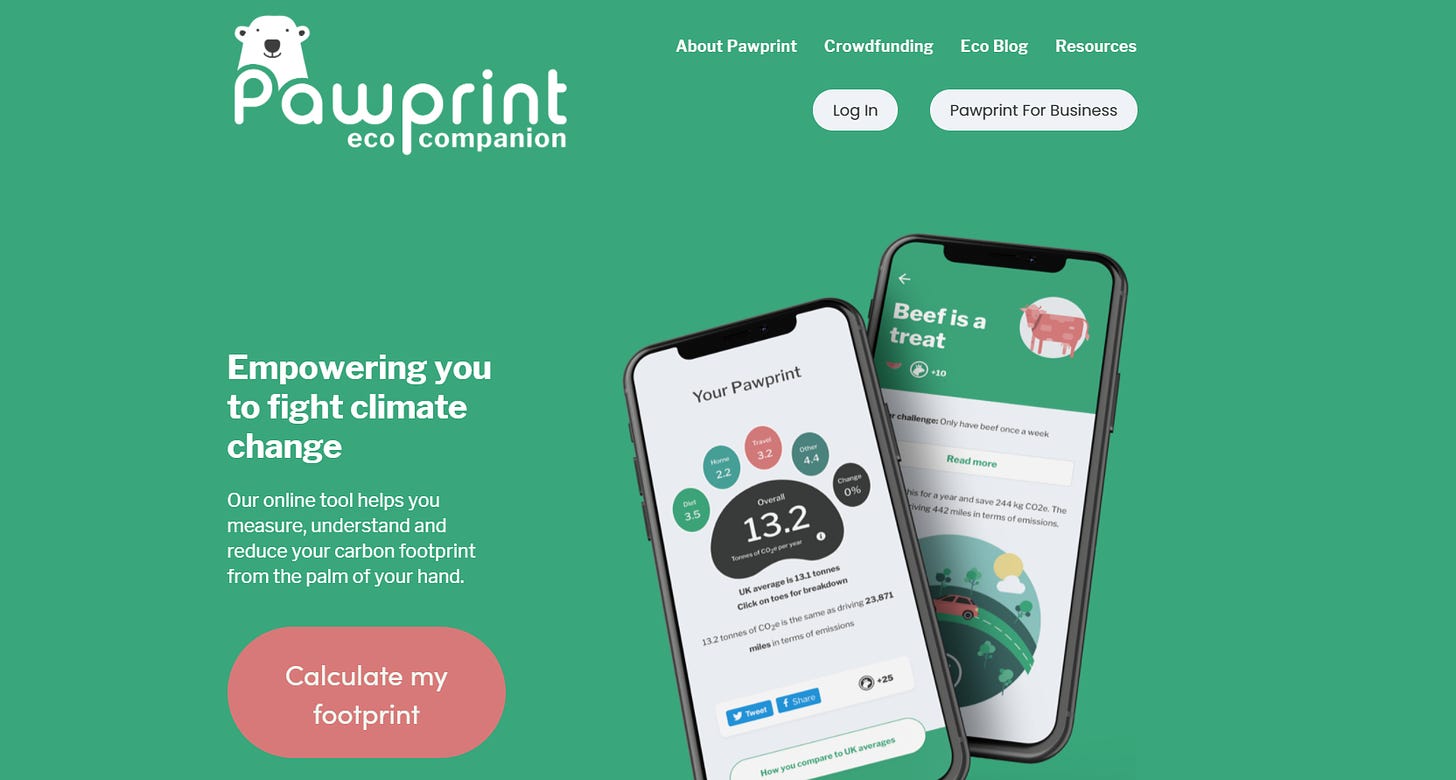

A carbon score based on your lifestyle.

Pawprint is an eco companion app helping users measure (via a science-based calculator) and understand your carbon footprint.

Tweet @PawprintEco to share they were featured in ‘Ecosystem’!

In my current day-to-day role, I look at supply chain tech. Now specifically focusing on solutions to measure/reduce/quantify carbon footprint. What are the startups working at the intersection of supply chain and sustainability I should know about?

Startup Go-to Resources

The bi-annual Marketplace Conference December 1st and 2nd 2020 - an online and global edition!

Join for keynote sessions, panel discussions and networking covering everything marketplaces: from design, strategy, growth hacking to fundraising. Organised by Autotech Ventures, Battery Ventures and Speedinvest x

What You Do Is Who You Are: How to Create Your Business Culture by A16Z's Ben Horowitz."Because your culture is how your company makes decisions when you're not there."

The B2B SaaS Pricing Masterclass - how subscription software companies price, package, and position their products

Founder Narrative Fit - what is it, how investors detect it and why they invest in it. A great podcast interview of Katherine Boyle (Partner, General Catalyst) with useful tips for founders and anyone working in venture.

Ever wondered what are tools investors use day-to-day? Balderton's Francesco Corea maps out the The VC Tech Stack (useful read for startup founders and employees too!)

Thank you for being part of the second ‘Ecosystem’ newsletter!

*Kaiku helps startups to source early stage funding, become investment ready and find the right partner network to scale.*