Risk. 'Ecosystem' #27

A weekly guide on tech news and early stage fundraising. Aiming to open access to venture capital for less networked founders and junior VCs.

For access to all monthly events, archive or if you would like to support the project, become an annual subscriber⭐

Hello and welcome to issue #27!

Risk. Threat. Opportunity. What comes to mind when you think of an iconic tech company? Yes, they were born out of risk but they survived and succeeded because of the good ability to evaluate risk itself.

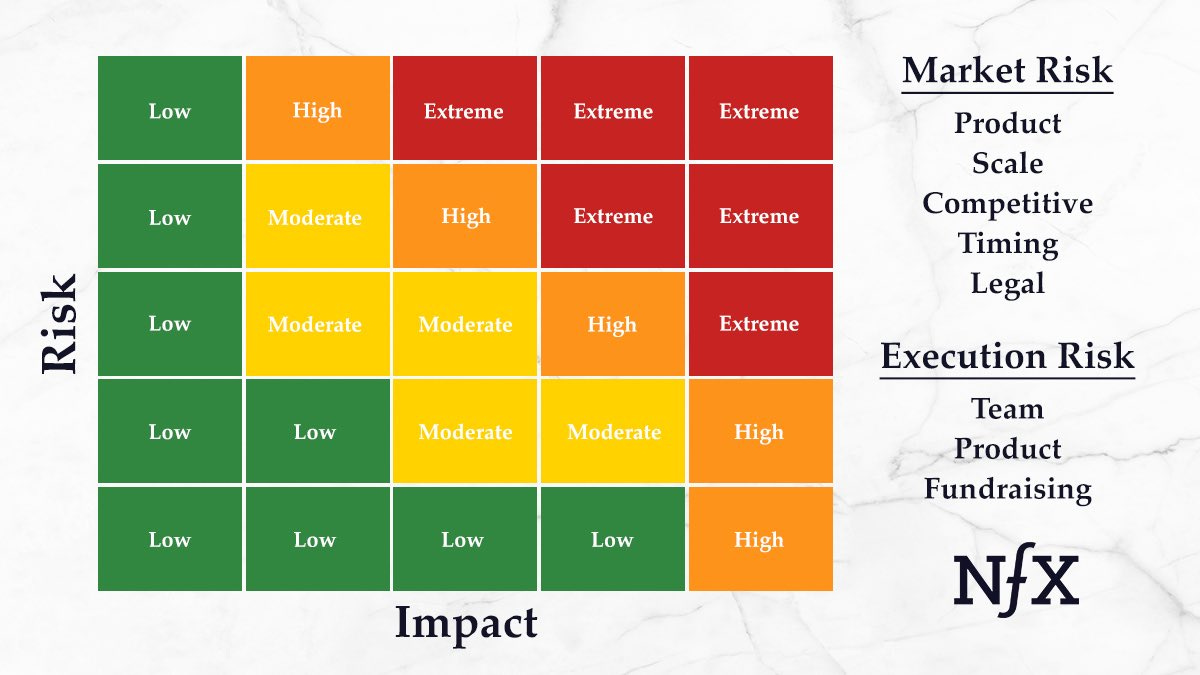

To build a moonshot startup, taking and understanding risk, is crucial. According to Pete Flint (General Partner, NFX), founders trade off between market (do people want what you are building?) and execution risk (are you able to execute your idea at least 10x better than the competition?).

For a more detailed breakdown of what these two types of risk mean and where they derive from, watch his in-depth explanation. For insights on evaluating risk when investing, check out the #EcosystemGiants summary.

With risk taking, comes decision-making. What prevents us (as people) from taking risk and causes hesitation when making complex decisions? Studies say it is the desire to avoid pain; or more explicitly fear. Humans are said to respond to fear (threat) in four ways:

Fight, Flight, Freeze or Face (proven to be the most effective response)*

So when evaluating risk, it may help following a structured decision-making framework. Break down the process in several steps - study the options (analyze the data; spot patterns), decide (make the choice and stick with it), communicate (the ‘why’ or the logic behind a decision; especially if external stakeholders are involved) and act (quickly).

A decision only becomes real when actions are taken that move it forward. Waiting to decide is a decision in itself - and it may lead to both not taking the chance (rewards) and missing out on the opportunity by avoiding the risk.

“While there has been a (healthy) education about the importance of taking calculated risks with business models, too often this has been accompanied by an unwillingness to think big enough and to tackle truly important problems.” - Pete Flint (General Partner, NFX)

What has your favorite part of the ‘Ecosystem’ project been? What can help you on your fundraising/VC journey that has not yet been covered here? Drop me a line :) Until next week! 👋

Thank you to everyone who has supported the project by becoming an annual subscriber, your recognition means a lot and you help drive ‘Ecosystem’ forward.

*I suggest reading The Science of Fear by Daniel Gardner if into this subject.

"I’m here today because of the women who came before me. I may be the first to do many things—make sure I’m not the last.” - Kamala Harris

#EcosystemGiants

The new season of #EcosystemGiants is off to a strong start! It was amazing to be able to speak with Benjamin Erhart (Partner, UVC Partners) about his journey in venture, evaluating risk and moonshot investing. Few excellent takeaways (including insights on pattern-matching!):

Learning comes through experience and spotting/tracking investment patterns takes time. Investors, be mindful of possible misjudgments around product-market-fit (the readiness of the market) and the team dynamics as conflicts between founders can be the biggest distractor of value.

Going where no one has gone before can be more effective than tracking (diversity) statistics. The best way to teach a venture firm to become more open? Having them see the missed opportunities.

And finally, Benjamin shared the way failure is seen in venture capital has changed over the last 12 years:

“When I started in venture capital, losing money was something very stigmatic. If one had 3 or 4 bad investments in portfolio, that could really impact the career path heavily. Now, the opportunity to build unicorn companies is here for both founders and VCs.”

To funders:

“Do your job well, hunt for opportunities and deal with risk openly, without fearing what may go wrong.”

To founders:

“Make the value of what you're about to do transparent to the investor. You need large, clear problems to build large companies. Tailor your pitch to the class of investors you are presenting to. The larger their vehicles and potential investments, the clearer they must understand that the challenge you are addressing is sizable enough.”

If you missed out on the conversation with Benjamin, the recording will be online soon (or go for the full 2020 archive of ‘Ecosystem Giants’). Who is the next guest? I am truly beyond excited to share. Can only say it is a personal role model - keep an eye out for an email tomorrow :)

Innovation Ecosystem Updates

Whether you are an investor, a founder, an operator, a corporate or a friend. The top news stories this week you may find of interest.

Trending. Facebook’s review of Trump ban could set a critical precedent for how the tech giant handles world leaders’ political speech (Axios). WhatsApp facing one of the largest privacy fines (up to €50M) under the EU’s data protection rules (Politico). Jack Ma reappears & Alibaba's shares surge (Bloomberg). Austrian crypto-broker Bitpanda introduces a debit card to allow users to pay in digital assets such as Fiat, Crypto and Precious Metals (Coindesk). Alphabet grounds Loon, a 2013 moonshot project to beam internet from high-altitude balloons (Wired). Is traditional media getting unbundled? Forbes launches a subscription newsletter platform (Axios). And finally, an end of an era for London fintech. Monzo founder-turned-president Tom Blomfield is leaving the UK challenger bank (Sifted).

Massive rounds. Munich-based HR scaleup Personio lands €103.5M series D funding at a €1.4BN valuation (EU-startups). Huge funding rounds out of London. Witnessing 160% YoY growth in revenue last year, online flower delivery and gifting startup Bloom & Wild raises $102M to expand into Europe (UKTN). And Amazon-backed food delivery firm Deliveroo secures $180M pre-IPO funding round, pushing its valuation to above $7BN (Business Insider). Multiverse, a startup connecting apprentices with companies secures UK’s biggest ever edtech raise at $44M (founded by Euan Blair, son of former PM Tony Blair) via Sifted. Interesting fact: All of the above four companies are Index Ventures-backed. And more fundraising activity in the on-demand delivery market. On-demand delivery apps Getir (Tukey) and Glovo (Spain) get $100M+ each in ‘dark store’ drive (AgFunderNews).

IPOs. German online retailer Mytheresa valued at $3bn after US listing (shares jumped more than 37% in the market debut) via Reuters. Digital health startup Hims & Hers goes public in $1.6BN SPAC deal (Forbes). And more SPAC filings. Financials-focused SPAC, led by former Paysafe CEO and Director Joel Leonoff, JOFF Fintech Acquisition files for a $300M IPO (Nasdaq) and real estate technology SPAC Fifth Wall Acquisition to raise up to $250M in an initial public offering (Nasdaq).

Sustainability. Blue Horizon Ventures launches €183M foodtech fund to invest in alternative proteins, synthetic biology, cell-based food, smart packaging and food waste ventures (Tech.eu). Elon Musk to give $100M for carbon capture tech solution (Techcrunch) and Founder and CEO of Social Capital, Chamath Palihapitiya is announcing a new, big PIPE climate investment (watch this space!).

Wins for women. An empowering week for female leaders in tech and beyond 🙌 More female VC partners. Lucile Cornet is Eight Roads Ventures’ newest (and first female) partner (Techcrunch). Wendy Xiao Schadeck becomes Northzone’s first New York partner (Techcrunch) 👏👏 History made. Highest number of women to serve in President Biden’s cabinet (MarketWatch). Oh, and at age 22, the youngest inaugural poet in U.S. history is now female (CBS). Why did Amanda Gorman’s inauguration speech make history? (Vanity Fair). 👏

Funder

“Beyond overseeing the management team, boards should also provide oversight on key decisions. Signing an office lease might not seem like a board-level decision, but with early-stage startups, that lease might very well be a financial liability that significantly exceeds the company’s total cash in the bank. While these formal board responsibilities might seem simple, in practice they are too important to be left to amateurs.”

Reid Hoffman (Partner, Greylock) on building a great startup board

“Building a startup isn’t easy and the path is never straight forward. But focus and determination goes a long way… Looking back at our investments from Fund I, we reached conviction on average with just two(in person) meetings.

Following the announcement of Fund II, Ophelia Brown (Founder, Blossom Capital) shares thoughts from the journey deploying Fund I to date, lessons learned and future plans

“The next time you hear someone say the reason they haven’t invested in more female founders is because of a pipeline problem, and if they haven’t already done a huge amount to try and fix it, please point them to the data in this blog.”

William McQuillan (Partner, Frontline Ventures) 👇

Founder

Michael Acton Smith (Co-founder and Co-CEO, Calm) on how he built the world's #1 meditation app - acquiring early users, finding product-market fit and what he would have done differently scaling

From Ryan Hoover (Founder, Product Hunt) to Anna Binder (Head of People Operations, Asana) - 30 best pieces of advice for entrepreneurs from the First Round Review article collection in 2020

Tweet(s) of the week

Lillian Li, Investor, Eight Roads Ventures

Austin Rief, Co-Founder, Morning Brew

Startup of the week

The ultimate home for messages, DMs and more.

Texts is a desktop chat client, aggregating a user’s messages across some of the most popular messaging platforms (iMessage, WhatsApp, Telegram, FB Messenger, Twitter and Instagram) in one app. Archive. Snooze. Mark as unread. The goal? Never miss a message again. If you are managing multiple inboxes and after a unified experience, Texts may just be the solution you need.

Tweet @TextsHQ to share they were featured in ‘Ecosystem’!

I would love to hear from founders working on products/services that advance one or more of the United Nations Sustainable Development Goals. Are you building a purpose-driven startup I should know about?

Startup Go-to Resources

A Guide to the Term Sheet at seed stage - what clauses are viewed as the most important (and why) according to byFounders

An extensive collection of resources for product builders and leaders - covering product-market fit, metrics and growth, hiring and more (done by Deepka Rana, Investment Manager, Northzone)

VC 101: The Angel Investor's Guide to Startup Investing

How to develop an effective fundraising deck? Invaluable advice by Vinod Khosla (Founder, Khosla Ventures) to help you pitch the way VCs think

Want to break into VC? A step-by-step guide

A list of 30 podcasts to help you on your entrepreneurial journey

12 lesson from Sequoia's Don Valentine about venture capital and business. Legend.

Raising Your Round - a useful guide by Sahil Lavingia (Founder, Gumroad)

Thank you for reading another ‘Ecosystem’ newsletter! What feedback do you have for me (likes/dislikes)? I would greatly appreciate if you share this with contacts (founders, tech operators & investors) who may find the content helpful🖤