Start. 'Ecosystem' #25

Your weekly guide on tech news and early stage fundraising - democratizing access to the venture capital for less networked founders and junior VCs.

For access to all monthly events, archive or if you would like to support the project, become an annual subscriber⭐

Hello and Happy New Year! Welcome to issue #25, it is great to have you back! 👋 What a start into 2021!

Brexit (and related supply chain disruptions). A third UK nationwide lockdown. On Monday, collaboration tools Slack and Notion were down (and so was the productivity of millions of workers!). On Wednesday, the storming of US Capitol and the events unfolding left us watching with dismay. Big Tech stepped up to tackle misinformation and de-platformed President Trump, essentially revoking his social media (political) megaphone *(An interesting remark on the power of (social) media and why some rioters were clutching mobile phones ‘as weapons’)*. Oh and 5 new tech unicorns to start the year. Can you believe we are still in the single digit days of the year?

That’s far from all (see what else has been Trending below!). If you missed out on the 2020 in Review of the ‘Ecosystem’ Project, read few of the highlights here.

Wishing you a healthy and prosperous 2021! Dare to be bold, be kind and don’t stop working towards achieving your goals :)

“If everyone played it safe, we wouldn't get anywhere.” - Vinod Khosla, Founder, Khosla Ventures

“There just aren’t enough great examples of different types of people that are at the top. I feel a lot of responsibility in making sure that others can see themselves there, and not just a lot of men in suits.” - Katrina Lake, Founder and CEO, Stitch Fix

Enjoy the weekend! 💓

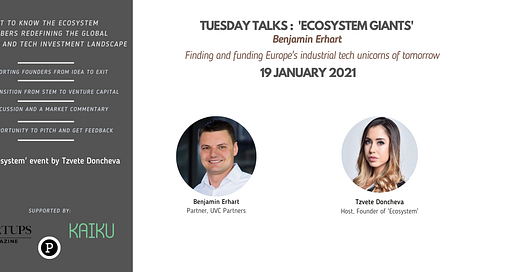

#EcosystemGiants

The first ‘Ecosystem Giants’ session of the year will be at 5pm GMT (6pm CET) on 19 January 2021. I am very excited to welcome Benjamin Erhart (Partner, UVC Partners) as the opening speaker. Before joining UVC Partners, Benjamin was Investment Director at the High-Tech Gründerfonds (where he still serves on the investment board), responsible for hardware and industrial software investments such as Cumulocity (Sold to Software AG).

With >70 years of venture experience and over 100 B2B transactions combined, UVC Partners is one of the leading early stage VC firms in DACH, investing in Industrial Technologies, Enterprise Software, and Mobility. Portfolio companies benefit from the extensive experience of the management team (strategic and operational support) as well as from the close cooperation with UnternehmerTUM, Europe's leading innovation and business creation center (access to a vast network of corporate partners). We’ll talk about finding and funding the industrial tech moonshots of tomorrow, his journey from industrial engineering to venture capital and lessons learned supporting founders from idea to exit. RSVP here to join.

Innovation Ecosystem Updates

Whether you are an investor, a founder, an operator, a corporate or a friend. The top news stories this week you may find of interest.

Trending. Where is China’s largest billionaire, Jack Ma?(Fortune). Elon Musk passed Jeff Bezos as the richest person on the planet (and is on track to become the world’s first trillionaire!) via Quartz. Each year since founded in 1817, hundreds of companies have gone public on the New York Stock Exchange (2020 marked a record for IPOs; 442 logged as of Dec 14). While thousands are currently publicly traded, only about 20 of those were founded and led by women (Business Insider).** Will Apple team up with Hyundai on a self-driving, electric car? The South Korean automaker first discloses co-development talks of the iCar (stocks rose 20%), then revises statement twice (Fortune).

Sustainability. UK banks to launch wave of green products (Financial Times). Union Square Ventures launches a $162M Climate fund, focused on the restructuring of society and the economy in response to the climate crisis

We believe that the Climate Crisis will change the economy over the next 20 years the way the Internet has over the past 20 - more details here.

Big Rounds. Nine-year-old Berlin-based SaaS banking platform Mambu raises $135M at a $2BN+ valuation (Techcrunch). Across the Pond, WeLink, a next-generation fixed-wireless broadband provider lands $185M in financing for 5G network rollout (Pymnts). Analytics software maker Starburst Data raises $100M in Series C funding led by Andreessen Horowitz (reaching $1.2BN valuation) via Bloomberg. After burning through $2 billion, construction tech startup Katerra gets a $200M SoftBank lifeline to escape bankruptcy (Techcrunch).

IPOs and exits. Online lender SoFi to go public in merger with Chamath Palihapitiya’s newest SPAC (Techcrunch). Social fashion platform Poshmark is to move forward with its initial public offering (Crunchbase). Alternative milk company Oatly is eyeing a 2021 IPO that could raise $1 billion (CNBC). VC firm Fifth Wall to launch proptech SPAC (The Real Deal). Virtual events platform Hopin acquires video streaming studio StreamYard for $250M (Venture Beat).

Wins for women. 18 female leaders featured in the annual Venture Capital Journal’s 40 under 40 Rising Stars of the VC community list. Congratulations to all shortlisted inc fellow Bulgarian Mina Mutafchieva (Senior Principal, Dawn Capital), Laura Thompson (Principal, Sapphire Ventures) and Jillian Williams (Investment Principal, Anthemis). 👏

**While we as society, collectively, need to work on closing the entrepreneurial gap and support female founders to change these stats and achieve gender equality. On the topic of gender equality and female empowerment, check out Tessy Antony De Nassau's Zoom O'Clock podcast with women rights lawyer, Cherie Blair (super inspiring!). But back on the very few female-led companies taken public, perhaps a silver lining is the data shows a promising trend. Yes, there are only 20 female-led companies on the New York Stock Exchange. But eighteen of them were listed in the past seven years (five only in 2020!). Will we see >5 companies listed in 2021? 🤞

Funder

Bringing your investment opportunity to life is the art of the pitch. The goal is for VCs to learn about you as founders, your business, your progress to date, your goals, your investment requirement, and most importantly what role and return they are being offered.

Looking to raise institutional capital in 2021? From honing the investor proposition to structuring your data room, Ian Merricks (Managing Partner, White Horse Capital)’s five tips to help you begin preparing for VC funding

Soraya Darabi (General Partner and Co-Founder, TMV) on starting a venture fund, assessing early stage founders and where change needs to begin in VC

One big lesson reinforced to me in 2020 was to stay small, stay nimble. Fixed costs are a bear. I’ve been trying to refactor everything I do to move away from fixed things to variable ones, and if there’s one bright spot operationally from 2020, it would be this lesson.

Planning, not predictions. Looking ahead to 2021, Semil Shah (General Partner, Haystack) does an alternative take on the yearly investor predictions, sharing his preparations for the coming year

Founder

What advice do six female leaders like Anne Boden(CEO and Founder, Starling Bank) have for other women on becoming financially literate and better managing their wealth? Marija Butkovic (Founder, Women of Wearables) gathers their key advice via Forbes

Why ‘invest in public’ and why now? Tod Sacerdoti (Founder and CEO, Pipedream) writes an extensive intro guide on angel investing, summarizing the lessons learned from 100+ angel investments as an operator

Twitter Highlight (s)

Kulveer Taggar (CEO and Co-Founder, Zeus Living)

Maren Bannon (Co-Founder and Managing Partner, January Ventures)

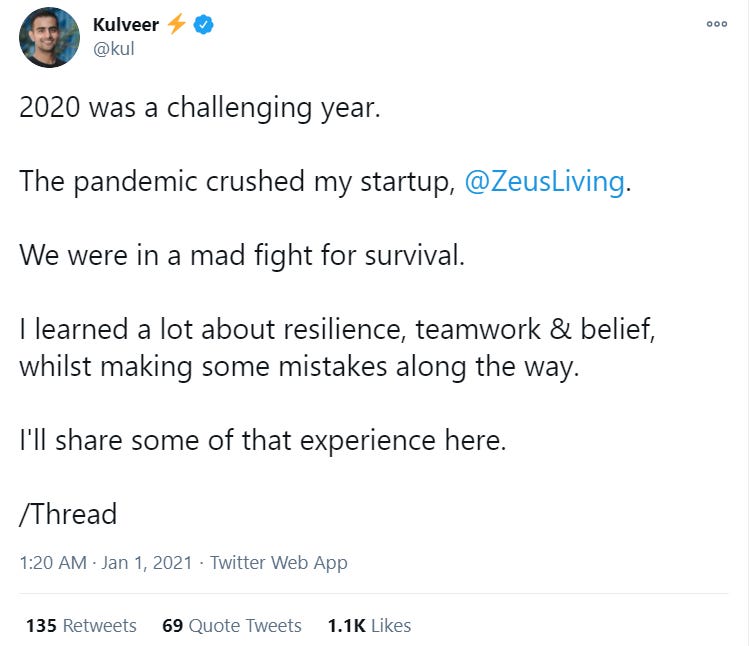

Startup of the week

Diamonds made from air

Aether are the world’s first carbon-negative diamonds. Planet loving and climate positive (claim each diamond produced permanently removes carbon from the environment!). Tweet @AetherDiamonds to share they were featured in ‘Ecosystem’!

Startup Go-to Resources

A Guide to the Term Sheet at seed stage - what clauses are viewed as the most important (and why) according to byFounders

How to develop an effective fundraising deck? Invaluable advice by Vinod Khosla (Founder, Khosla Ventures) to help you pitch the way VCs think

Signals VC Maps out the DACH Pre-Seed VC Landscape

12 lesson from Sequoia's Don Valentine about venture capital and business. Legend.

Remote working tips and team building activities for companies of all sizes

Measure What Matters: How Google, Bono, and the Gates Foundation Rock the World with OKRs - or the goal-setting system of objectives and key Results that helped tech giants achieve explosive growth

Top marketing mistakes founders make - and what early stage startups should avoid

Marketing and Demand Generation in B2B SaaS - a must listen interview of Vidya Peters(CMO, Marqeta) on Venture StoriesThank you for reading another ‘Ecosystem’ newsletter! I would love to hear your feedback and please share with contacts who may find it helpful.