Vision. 'Ecosystem' #24

Your weekly guide on tech news and early stage fundraising - democratizing access to the venture capital for less networked founders and junior VCs.

For access to all monthly events, archive or if you would like to support the project, become an annual subscriber⭐

Hello and welcome to issue 24!

Vision. From promoting social change to driving innovation, entrepreneurship is key to further economic development. And venture is only one type of financing - with the odds of successfully raising investment ranging from 0.2% (Forward Partners data) to 0.7% (A16Z data).

It is where the importance of vision comes in - daring to think big and boldly painting the grand picture in your pitch.

“Venture is not investing into the status quo or investing in the numbers you have today, it is investing in the journey that still lies ahead of you.” - Judith Dada, Partner, La Famiglia**

What is the story that will inspire others (from investors to prospective employees) join you on this journey?

Decision-making in venture was a theme covered in the last ‘Ecosystem Giants’ event for 2020, a conversation with Jan Miczaika (Partner, HV Capital) earlier in the week.

“Venture is about making decisions under uncertainty – investors are looking to collect as much information in as little time possible to reduce the level of this uncertainty.”

Grit and ambition are some of the qualities he values greatly in founders. It was humbling to be able to speak with Jan about starting/scaling companies as one of Berlin’s most successful startup operators and his journey to becoming a partner at HV Capital, a leading early-stage and growth venture capitalist in Europe. More key lessons shared:

Starting a company is stressful – building or joining a support network with people you trust (and who are non-competitive) can help you get through the lows.

When letting people go, do it promptly, be direct and keep the process short.

On angel investing:

Be deliberate about the asset class and precise about the amount of money you are able to allocate.

It will take time - a recommendation to build a portfolio of at least 10 investments.

Have a clearly defined value-add as an investor.

Without exaggerating, it was one of the most insightful sessions to date and a great end to the first season of ‘Ecosystem Giants’. What has your favourite event been to date?

Enjoy the weekend👋 and stay tuned for the last ‘Ecosystem’ issue of 2020!

#EcosystemGiants

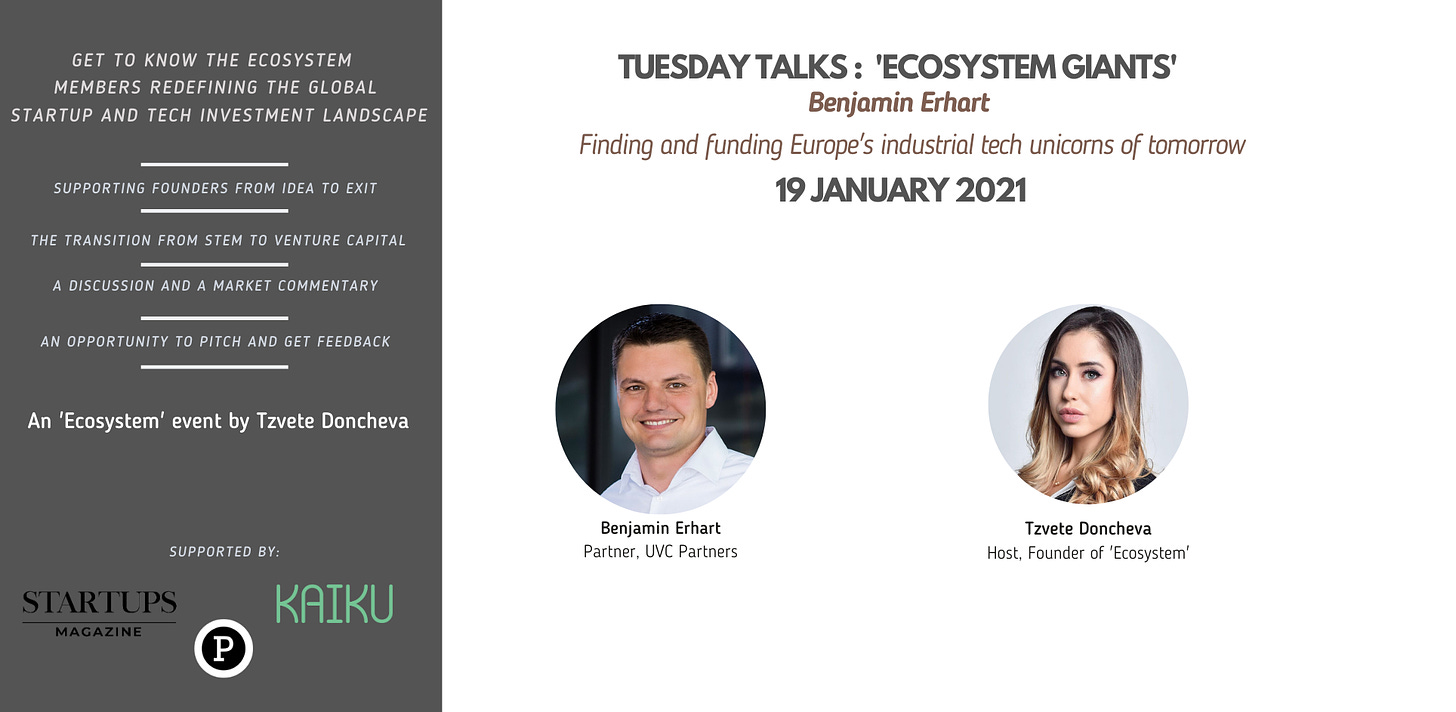

It has been a busy 2020 with 12 incredible guests at #EcosystemGiants - more on this to come! I am also very excited to announce Benjamin Erhart (Partner, UVC Partners) as the opening speaker in 2021!

Before joining UVC Partners, Benjamin Erhart was Investment Director at the High-Tech Gründerfonds (where he still serves on the investment board), responsible for hardware and industrial software investments such as Cumulocity (Sold to Software AG). We’ll talk about finding and funding the industrial tech moonshots of tomorrow, his journey from industrial engineering to venture capital and lessons learned in supporting founders from idea to exit at 5pm GMT (6pm CET) on 19 January 2020. RSVP here to join.

Innovation Ecosystem Updates

Whether you are an investor, a founder, an operator, a corporate or a friend. The top news stories this week you may find of interest.

IPOs. Coinbase, U.S. largest cryptocurrency exchange, files for IPO (CNBC). So does, UiPath robotic process automation company (and a Romanian moonshot!) (CNBC). Online marketplace for secondhand clothing Poshmark files for going public too (Fortune).

Trending. Where are top VCs and startups relocating to if leaving Silicon Valley? (Bloomberg). The future of driverless deliveries is here - Walmart’s trial with autonomous vehicle startup Gatik live in Arkansas in 2021 (The Verge)

Big Rounds. Estonian ride-hailing platform Bolt raises another $182M to expand to Europe and Africa (Techcrunch). Only six months after its Series A, Berlin-based booking engine cargo.one secures $42M in Series B funding (Tech.Eu). Out of France, Lydia closes the largest fintech round in the country’s history at $131M Series B (Sifted). Across the Pond, productivity software maker ClickUp hits $1BN valuation in $100M Series B (The Business Times).

Wins for women. Pia d’Iribarne (formerly of Accel and Stride) raises a $56M debut fund (New Wave) in three months (Techcrunch)👏 Women funding women - The Duchess of Sussex Meghan Markle makes her first startup investment in female-founded instant latte-company Clevr Blends 👏Sonali De Rycker (Partner, Accel), Luciana Lixandru (Partner, Sequoia), Reshma Sohoni (Co-Founder and Managing Partner, Seedcamp) and Laurel Bowden (Partner 83 North) recognized as top VC investors in ‘The Midas List Europe by Forbes’ 👏

Funder

“The higher you climb, the thinner the air.”

Following AirBnB’s IPO, Reid Hoffman (Partner, Greylock) reflects back on the firm’s decade long partnership with the company since leading their Series A in 2010 (and shares why he personally passed on the opportunity at seed!)

Founder/Operator

“Content is where I expect much of the real money will be made on the Internet, just as it was in broadcasting.” - Bill Gates

Nathan Baschez (VP Product, Substack) analyses media from a systems perspective, exploring the properties that make it a good source of power to explain why content is king

Giancarlo 'GC' Lionetti (Chief Marketing Officer, Confluent) on building companies through product-led growth - from the ‘Aha’ moments to capture a user to driving bottoms-up adoption (takeaways summarised by Redpoint Ventures)

Twitter Highlight

Beata Klein, Associate, Creandum

Gil Dibner, General Partner, Angular Ventures

Startup of the week

A personalized audio* coach to enhance your run

Lupa, a digital running studio guiding you through your cardio - what to do and how to do it to improve your running experience. In-app bonus : sightseeing navigations!

Tweet @we_are_lupa to share they were featured in ‘Ecosystem’!

*Another insightful post on why audio will fundamentally change the way people connect and businesses operate - this time by Talia and Gaby Goldberg (Partner & Associate, Bessemer Venture Partners)

Startup Go-to Resources

Y Combinator's Guide to Seed Fundraising - from why and when to raise money to what not to do while communicating with investors

Signals VC Maps out the DACH Pre-Seed VC Landscape

Robinhood Founder Vlad Tenev on building one of the fastest growing companies of the decade - leadership, (team) culture and managing fear/opportunity

Remote working tips and team building activities for companies of all sizes

Measure What Matters: How Google, Bono, and the Gates Foundation Rock the World with OKRs - or the goal-setting system of objectives and key Results that helped tech giants achieve explosive growth

Apply to join Antler Berlin and launch a tech venture. Find a co-founder, receive pre-seed funding, access mentorship and expand your network.

Top marketing mistakes founders make - and what early stage startups should avoid

Switch: How to Change Things When Change Is Hard by Chip and Dan Heath - an interesting read on one's rational/emotional mind and why successful changes follow a pre-defined pattern