Attention. 'Ecosystem' #32

A weekly guide on tech news and early stage fundraising. Aiming to open access to the venture industry for less networked founders and junior VCs.

For access to all monthly events, archive or if you would like to support the project, become an annual subscriber⭐ New to ‘Ecosystem’? Find out what it is here.

Hello and welcome back to ‘Ecosystem’, issue #32!

We are living in the age of extreme content overload. How could it be otherwise? We are surrounded by vast amounts of information instantly available to us online. 6000 tweets are tweeted every second. 80M user photos are uploaded to Instagram daily. More than 1.3M new users joined social media every day during 2020 (to put it in perspective, a typical one spends roughly one waking day of their life on social media weekly). Technology has democratized the way information is accessed/ shared, how we get informed and who we get informed from. A brief look back:

“Reading — and especially writing — was once a privilege of the elite. In the medieval ages, the ability to create and distribute books was in the hands of very few: It would take weeks and even months for a scribe in a monastery to copy books, and only members of the church or nobility would then be able to read them. By the 1500s, however, technology had begun to democratize access to books and brought to light the information contained within them. The printing press not only brought books to more people, it brought more writers — philosophers, scientists, others — and other reading materials — like pamphlets, posters, newspapers, and novels — to the world, and in doing so, changed culture.” - Andrew Chen, General Partner, A16Z

And more recently, tools like Substack have made it possible for a direct relationship between a writer/reader to be built; or in the case of CH, the platform has enabled even more creators build a following (the audio-first social app had 600K users in December 2020, 2M in January 2021 and 10M+ WAU at present!). But with ‘content’ so easy to produce, it has become increasingly harder to differentiate signal from noise. The question becomes not how to get people to hear you, but how to get them to listen and come back. Time may be a scarce commodity but what is even more rare is attention (it’s why this was the discussion topic of choice for the first ‘Ecosystem’ talk - stay tuned for key highlights!).

Of course, it has also never been easier to connect with new people - are our social circles indeed expanding or shrinking? How many of these online interactions will survive the test of time to turn into meaningful, long-lasting connections (offline)? We are yet to see.

As promised last week, putting a spotlight on another male leader we can all learn from - Andrew Wilkinson, Co-Founder, Tiny Capital. He specializes in buying, starting and investing in profitable tech businesses, and on the topic of brand, his firm, Tiny has become known as the Berkshire Hathaway of the Internet. I very much recommend listening to this podcast interview of his where he talks about the benefits of creating a strong differentiation point - in PE (positioning Tiny as the ‘acquirer of choice’), and in tech (as it helps to develop a strong*er* moat). Find him on Twitter for great tips on company building, delegation and inspiring quotes from history. Plus five of his frameworks summarized here.

Thank you for coming back and for continuing to choose this newsletter as the source of information on tech news and early stage fundraising! What do community members say about it?

Reading „Ecosystem“ enables me to quickly gain a comprehensive overview of the latest news in the VC ecosystem. Moreover, I love the timeless section „Startup Go-to Resources“ - I bookmarked so many resources! - Hannah van Vorst, Business Analyst, StudioHub

If you would like to share your thoughts and be featured, do reach out :)

Wishing you a productive week ahead! Until next Sunday! 👋

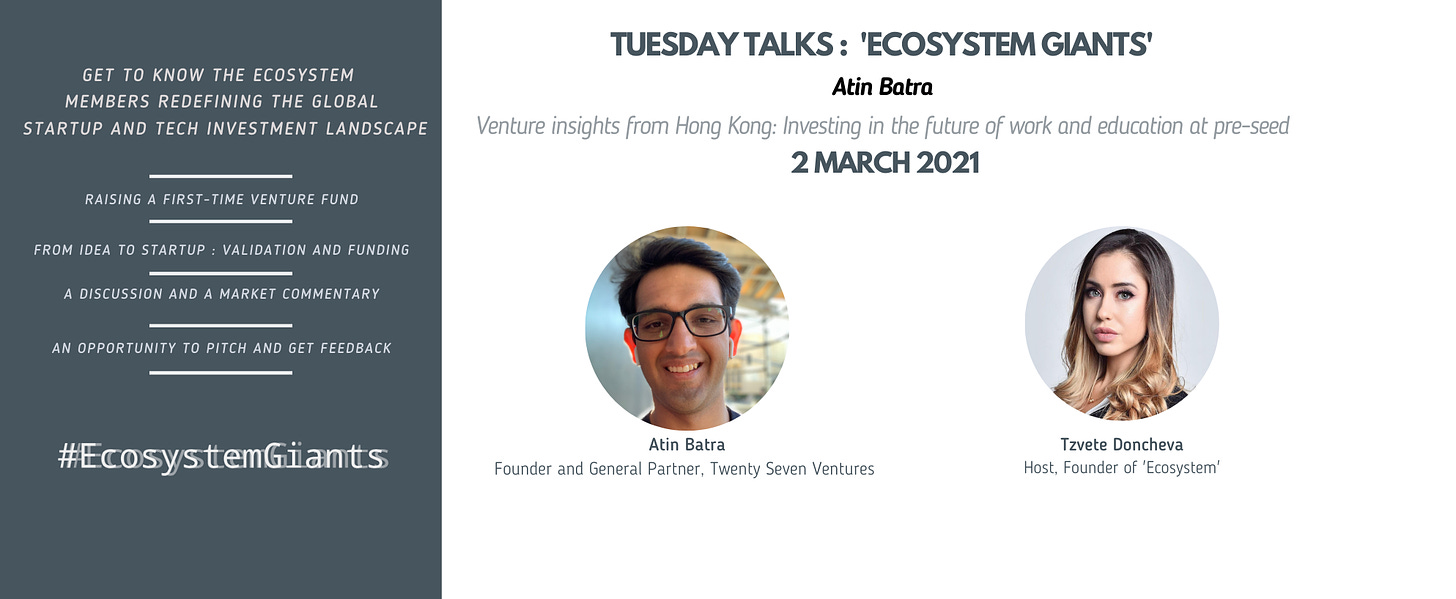

#EcosystemGiants

Very excited to welcome Atin Batra (Founder and General Partner, Twenty Seven Ventures) in #EcosystemGiants on Tuesday, 2 March 2021 (11am GMT/noon CET). HisVC fund, Twenty Seven Ventures is based out of Hong Kong and invests globally (pre-Seed/Seed) in the areas of EdTech and Future of Work. What are the pre-seed investment trends in Hong Kong and the state of the local startup ecosystem? Plus tips on raising a first-time fund (and differences/similarities to raising VC investment).

Tune in at 11am GMT (12pm CET) on Tuesday 2 March 2021.

Supported by community partners:

Startups Magazine, ParlayMe, Kaiku, When Unicorns Fly

Innovation Ecosystem Updates

Whether you are an investor, a founder, an operator, a corporate or a friend. The top news stories this week you may find of interest.

Trending. Robinhood faces nearly 50 lawsuits over GameStop frenzy (The New York Times). Stanford study shows “Zoom fatigue” is real - and the “non-verbal overload” of endless video calls is one of the causes (CNET). The European Commission launches consultation over future of gig economy (POLITICO). Twitter’s new ‘Super Follow’ feature to allow creators to earn money; taking shots at Substack and Patreon (Techcrunch). In a year of scientific breakthroughs — and political failures — what can we learn for the future? A summary by Yuval Noah Harari (FT).

Lakestar SPAC, the third blank-check firm ever to list in Germany and the first since 2010, gains in largest Europe Tech-Focused blank-check debut (Bloomberg). And more capital for early stage founders - Sequoia raises $195M for its newest, fourth seed fund (FinSMEs) and Bessemer Venture Partners closes on $3.3BN across two funds + more updates 👇

Massive rounds. Swedish payments scale-up Klarna raising $1BN at a $31BN valuation (CNBC). Barcelona-based virtual marketplace Wallapop secures $191M at valuation of $840M (Techcrunch). Two big fundings from The Netherlands. Fast-charging startup Fastned charges itself with €150M (Silicon Canals) and food tech startup Mosa Meat (that pioneered the world’s first cell-based beef!) closes a $85M series B round (Pitchbook). Paris-based digital soccer collectables platform Sorare bags $50M (Coindesk). And UK’s digital bank for the rich, Monument, lands £28M in new funding (Finextra).

Acquisitions. From the US, private equity giant Francisco Partners is acquiring Israel-based genealogy company MyHeritage for over $600M (Business Wire) and online consumer intelligence and social media listening platform Brandwatch snapped by Cision for $450M (Techcrunch). Strong exit for the German startup ecosystem - Shell to buy virtual power plant operator Next Kraftwerke at about $130 (Tech.Eu). Australian unicorn Canva acquires two European startups - Austrian visual AI platform Kaleido and Czech Smartmockups, a product mockup generator (EU-Startups).

Sustainability. A new European VC firm to back technologies reducing the carbon footprint of cities - 2150 holds €130M first close for its €200M debut fund (anchored and incubated by real estate fund manager NREP). Paris-based asset manager Tikehau Capital raises over €1BN for its T2 Energy Transition fund (Pitchbook). Sustainable battery revolution – German micro mobility company TIER and Northvolt partner to equip e-scooters with greener batteries and lower emissions. Techstars launches a podcast focused on climate tech innovation. 75+ early stage companies on the watch list of top climate tech investors - see the Airtable.

Wins for women. The Hustle Fund team (with GP Elizabeth Yin) raises $33.6M for the final close of its second global pre-seed fund (Forbes).👏2 new female partners at Bessemer! Congratulations to Mary D'Onofrio and Tess Hatch.👏 Startups founded by women accounted for fewer than one-fifth of new U.S. IPOs in 2020 - but there are signs of change. See the next female CEOs who could take their companies public (The Information). 👏The seven impressive Berlin-based female founders building fintech startups to watch out for in 2021 (Silicon Canals). 👏*Hear from impressive European female leaders from the world of fintech in an event by Speedinvest on March 10.

Funder

“With a team of just 10, and without even spending the cash they had raised (yes, profitability happens in startupland!), they reached €3.6M monthly revenue in January 2021 – that's 70x in just 12 months, when growth was not even the main goal of the team…

..In hindsight, it's remarkable that so few people were impressed by the stellar job Sorare had done to convince a number of soccer clubs & users to join the Sorare journey so early, when they had close to nothing to prove their vision nor their ability to deliver on it at scale! But in our case, this was also the advantage of being a generalist: you're not trapped into your own expertise biases ("this can't be done or won't work"), especially at seed stage.”

What does it take for a startup to go from ‘chasing VCs for their seed round to raising $50M with Benchmark 7 months later?’ Boris Golden (Partner, Partech) on the mind-blowing early trajectory of portfolio company Sorare, why they were a ‘nonobvious’ seed investment and how they became one of the hottest Series A in Europe - must read!

Jeremy Liew (Partner, Lightspeed Venture Partners) discusses how and why he backed Snapchat early and points out to the four things he looks for when making an investment in a consumer social product - must listen!

And while on the topic of consumer companies, Gaby Goldberg (Investor, Bessemer Venture Partners), shares her four part framework when evaluating early stage companies in the space - “Why do people come? Why do people stay? Why do people share? Why do people pay?”

Founder

“Social influence rests on the fact that, when faced with an abundance of choice, we habitually rely on others to know what to buy, read, wear, or listen to. When these others are “regular” people just like us, we tend to trust them more than we would a compensated spokesperson, a model in an ad, an invisible editor, or a distant celebrity. Influencers are close and relatable, and we perceive their recommendations as “honest” and “authentic.”

Ana Andjelic (Chief Brand Officer, Banana Republic and Author, ‘The Business of Aspiration’) explains the phenomenon of social influence - and how brands can strategically use it to reach a wider yet more targeted audience

Ed Shrager (Co-Founder, Joggo) on the lessons learnt from going and growing through a pivot

Twitter Highlight (s)

Elizabeth Yin, General Partner and Co-Founder, Hustle Fund

Roger Ehrenberg, Managing Partner, IA Ventures

Startup of the week

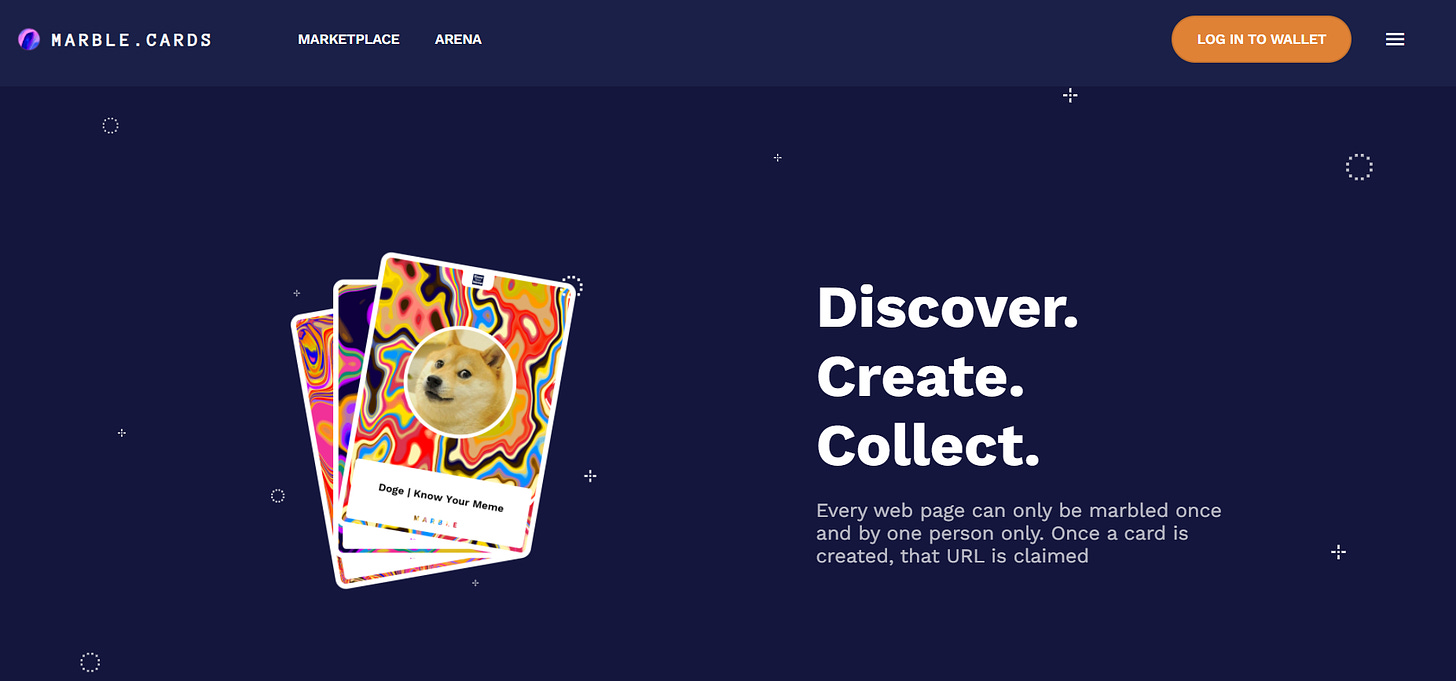

Create and trade unique digital cards based on URLs

Marble.Cards is a collectible card game based on web URLs. Every web page can only be marbled once and by one person only; and once a card is created, that URL is claimed forever. A way to save digital memories as crypto collectibles (remember this article from last week’s newsletter? ;)).

Tweet @marble_cards to share they were featured in ‘Ecosystem’!

Are you building a purpose-driven startup I should know about? Do reach out to me if working on a product advancing one or more of the United Nations Sustainable Development Goals. I’m also particularly interested in the Creator Economy - and would love to hear from you if building something in the space.

Startup Go-to Resources

Eight Ways to go Viral - What do Facebook, LinkedIn and Youtube have in common? An insightful article by Uzi Shmilovici (CEO and founder, Future Simple) on building viral features to accelerate growth

Cap tables, share structures and valuations - Christian Gabriel (Co-founder and CEO, Capdesk) on managing startup equity

The Community Playbook Cheat Sheet by The Community Fund

A curated collection of investment memos and investor essays

- gold!

Profitability from day one, a simple yet viral product - Tope Awotona on building Calendly

Turning 'Adjacent' users into engaged ones - an in-depth analysis by Bangaly Kaba (EIR at Reforge; Former VP Growth at Instacart & Instagram) inc examples for Slack and Instagram

What does data (30,000 data points to be exact!) reveal about billion-dollar startups? Pre-order the book by Ali Tamaseb or see the thread with insights

A visual communication planner : getting from idea to results

The features that can make or break a product - Whitney Wolfe Herd (Founder and CEO, Bumble) on Masters of Scale

The must-read guide for remote teams - frameworks on (a)synchronous meetings and more

The "Eisenhower Box" - how to be more productive and eliminate time wasting activities?Thank you for reading another ‘Ecosystem’ newsletter! What feedback do you have for me (likes/dislikes)? I would greatly appreciate if you share this with contacts (founders, tech operators & investors) who may find the content helpful🖤 Connect with me on Twitter