Knowledge. 'Ecosystem' #37

A weekly guide on tech news and early stage fundraising. Aiming to open access to the venture industry for less networked founders and junior VCs.

For access to all monthly events, archive or if you would like to support the project, become an annual subscriber⭐ New to ‘Ecosystem’? Find out what it is here.

Hello and welcome back to ‘Ecosystem’, issue #37!

Happy Easter weekend to all celebrating! I hope you had a fantastic holiday with your family and close ones and are feeling recharged to start the new month :) Let’s make it the best one yet!

Thank you for continuing to choose the ‘Ecosystem’ newsletter as your source of information on tech news and early-stage fundraising!

See you next week! 👋

#EcosystemGiants

For the first time at #EcosystemGiants, we got to hear the perspective of an LP on the venture ecosystem and the early stage landscape. And what an amazing guest that was! An absolute honor speaking with Laura Thompson (Partner, Sapphire Partners, the LP arm of Sapphire Ventures). It was a truly insightful conversation covering topics from evaluating fund managers, to the role of LPs in funding inclusive innovation. Few memorable takeaways from our chat:

Early-stage venture is a people business

“As an LP, we're essentially giving a blind pool of capital to a manager. We are trusting this manager to make all the decisions about where to invest. It really is a bet on people, their judgment and their learnings. There are quantitative elements in terms of looking at track records and in terms at how different markets are performing - but you pair that with a read on people. Venture is hard - and so you really want to understand what motivates someone, why they're doing what they are doing and what success means to them.”

The importance of an investment record

“We look at historic investment work - prior funds, an angel track record; where someone has been investing historically, and how it relates to what they're trying to do going forward.”

The LP/VC relationship takes time to build

“We think of it as a very long-term relationship. It is quite rare for us to meet someone while they're fundraising and commit because we plan to partner with them for many cycles. We take time to get to know them and form that relationship. Usually, when we make a new commitment, it's been someone that we've been getting to know a little bit over time. It is that read on people. And when our (existing) managers perform, we always re-up with them. The bulk of commitments I make is to existing managers, but we make sure to structure our programs so that we can partner with a few new groups a year.“

The point of differentiation

“The market is very crowded today. When I look at a pitch, I want to immediately understand what part of the market, this team or individuals are playing in and at what stage. How does it relate to their previous work? A lot of it is about the team - have they worked together and where are they complimentary? How many investments has this person or team made? Are they relevant to the strategy today? Venture is hard. Can this group or person find a new investment? Is it based on a network or on a specific kind of data - and how are they finding these? Then can they pick them - which is very, very hard at the early stages. Ultimately, looking for the evidence to select strong investments and win them in this environment.”

Increasing transparency in the LP world via #OpenLP

“The LP part of the ecosystem is very opaque. It's hard to find information - LPs tend to not be as public with their strategies and insights. The inception of #OpenLP was the desire to provide a little bit more transparency across the ecosystem; aggregating information from different sources (entrepreneurs, GPs and LPs) on the market and fundraising.”

Find out more about #OpenLP here.

Supported by community partners:

AccelerateHER, Startups Magazine, ParlayMe, Kaiku

Who is the next guest #EcosystemGiants guest? I can only reveal it is an investor with an angel track record that includes German unicorns Tier Mobility and Gorillas. Stay tuned for an email on Wednesday :)

Innovation Ecosystem Updates

Trending. Prolific investor Tiger Global, closes one of the biggest venture funds ever, with $6.7BN (Silicon Republic). Data breach at Facebook - emails, phone numbers of 533M users leaked online (The Verge). Microsoft wins a contract worth ~ $22BN to outfit the United States Army with 120K AR headsets over 10 years (CNBC). Amazon returning to an ‘office-centric culture’ by fall this year (MarketWatch). Elon Musk to join the board of entertainment and events company Endeavor (firm behind the Miss Universe) ahead of IPO (Business Insider). With shares down nearly 30% in day one of trading, was Deliveroo’s public market launch the worst in London’s history (CNN)? SoftBank-backed real estate brokerage Compass cut in half the scale of its ambitious IPO (Reuters). More on why the first IPOs of Q2 face delays and declines (Bloomberg). Betting on reputation via new crypto platform Bitclout - and why it has polarised the VC community (Business Insider). The top 29 UK VCs to follow on Twitter (Sifted).

Massive rounds. Europe’s food delivery market is on fire. Delivery startup Glovo raises $528M in Spain’s biggest funding round to date (Business Insider). Milan-based online grocer Everli bags $100M series C (Tech.EU). Scoop: London-based on-demand delivery and 'dark' store operator Zapp picks up backing from top VC firms Atomico and Lightspeed in its yet to be announced series A round (Techcrunch). Dutch end-to-end marketplace for end-of-season fashion Otrium raises a series C of $120M from household names Index Ventures and Eight Roads Ventures (TechCrunch). Across the Pond, barely weeks after its latest cash injection of $50M, ‘Nasdaq for revenue’ startup Pipe bags another $150M at a valuation in excess of $2BN (Techcrunch). New York startup Holler that uses AI to better understand context and nuance in messaging with a $36M series B to power up next gen chats and improved conversations (FinSMEs).

Acquisitions.Website-hosting company worth $10BN Squarespace acquires restaurant-services provider Tock for $400M+ in a mix of cash and stock (Bloomberg). Online pinboard site Pinterest in talks to buy photography app that spawned a teenage social media craze, VSCO (The New York Times). World leader in visual communications Getty Images is acquiring royalty-free image site Unsplash (Digital Information World). Music platform giant Spotify enters the live audio game, as it snaps up Clubhouse-like app, Betty Labs (The Verge).

Sustainability. Asther (Early stage VC), Khosla Ventures (Growth VC), Next47 (Corporate VC) top the inaugural Climate 50 list by Contrarian Ventures; an initiative seeking to recognise the most impactful investors in climate tech. ETF Partners won people’s vote as favourite VC. World’s largest asset manager BlackRock names ex-Obama climate aide Paul Bodnar as sustainable investing head (Axios).

Wins for women. Strong additions to the leadership team at EQT Ventures, a European investment firm that raised > $1.4BN. Founder turned VC investor Laura Yao promoted to partner and ex-Zendesk Anne Raimondi joins as operating partner (TechCrunch). 👏 California-based VC firm Canvas Ventures, led by Rebecca Lynn closes a third fund at $350M to back visionary founders in fintech, digital health, logistics (FinSMEs). 👏 Investor Kirsten Green (Forerunner Ventures) tops Business Insider’s inaugural list of the 25 best female early stage investors and ranks #12 on the SEED 100, highlighting the best VCs investing in seed (Business Insider). 👏

Funder

Sophia Bendz (Partner, Cherry Ventures and (Advisor, Atomico) on navigating a successful career in venture, angel investing and supporting the next generation of entrepreneurs

“That is true for a small VC as much as it is for any startup. You need to reinvent what you’re doing at every stage. You work as much as you can to be different.”

Finn Murphy (Principal, Frontline Ventures) explains why and how he actively tries to be different as an investor - and what founders can learn from this approach

Founder

Austin Rief (Co-founder, Morning Brew) on the three stages of direct-to-consumer, nailing down the distribution channels and the DTC brands to learn from

Can Europe produce a social media giant? Sameer Singh (Founder, Breadcrumb.vc and Atomico angel) gives us the lowdown

Twitter Highlight

Beata Klein, Associate, Creandum

Naval Ravikant, CEO and co-founder, AngelList

Startup of the week

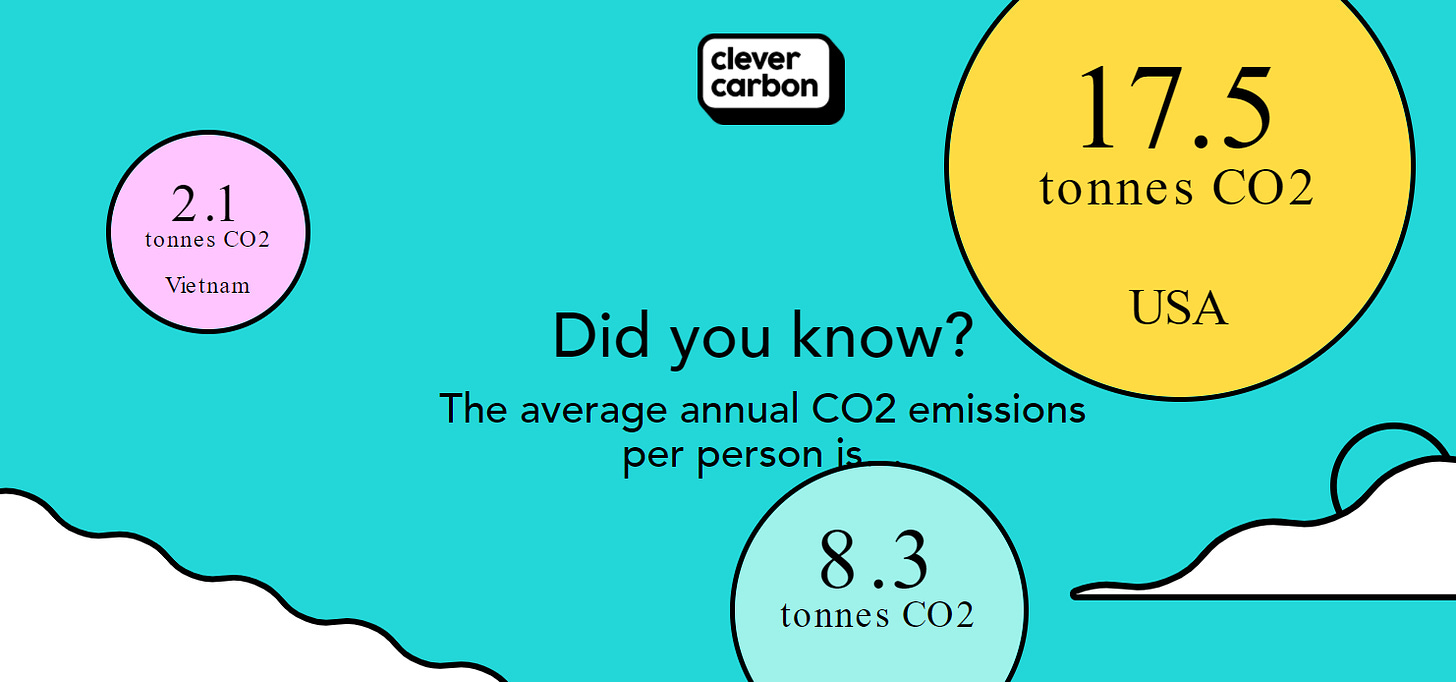

Become carbon literate in minutes

Carbon Footprint aims to raise carbon literacy in a relatable, easily digestible to the public way. Did you know your individual carbon footprint is made up of three main categories - household, transportation and consumption; and is likely to average 28KG a day? The startup helps users understand their CO2 emissions (via a 2min quiz!) and improve the carbon decisions for (our)theirselves and the planet.

Tweet @clever_carbon to share they were featured in ‘Ecosystem’!

Do reach out to me if working on a product advancing one or more of the United Nations Sustainable Development Goals. I’m also particularly interested in the Creator Economy - and would love to hear from you if building something in the space.

Startup Go-to Resources

From the things to know before starting a company to marketing and fundraising - THE field guide for early stage founders by Unusual Ventures

5 ways to build a $100M business - an infographic by Point Nine Capital

You can't measure what you can't see - The startup guide to analytics

Why do you startup? A fantastic short essay by Ruby on Rails creator, David Heinemeier Hansson

The must-read guide to syndicatesBuilding a personal monopoly through writing online - an interview with Jack Butcher(Founder, Visualize Value)

50 Best Pitch Deck Examples from YC & 500 Startups

How should a bottom up company think about B2B pricing and packaging? via A16Z

The perfect series A deck - a template by Creandum

All about valuations

Thank you for reading another ‘Ecosystem’ newsletter! What feedback do you have for me (likes/dislikes)? I would greatly appreciate if you share this with contacts (founders, tech operators & investors) who may find the content helpful🖤 Connect with me on Twitter