Outlook. 'Ecosystem' #36

A weekly guide on tech news and early stage fundraising. Aiming to open access to the venture industry for less networked founders and junior VCs.

For access to all monthly events, archive or if you would like to support the project, become an annual subscriber⭐ New to ‘Ecosystem’? Find out what it is here.

Hello and welcome back to ‘Ecosystem’, issue #36!

Is your glass half-empty or half-full? The answer to this well-known question about positive thinking likely not only reflects your outlook on life, but also attitude toward yourself - and may even affect your well-being. The way you perceive the world impacts how you handle stress and how you make decisions. The importance of managing your psychology really can’t be stressed enough - in building a startup and in building a life.

“The quality of your mind is the quality of your life.” - Naval Ravikant (Co-Founder, AngelList)

Every week, I try to change up this intro section, making its broader theme relevant to a resource/concept/personality I’ve come across or thought about over the last days. A tech leader I didn’t know too much about until very recently is Jason Fried (Founder and CEO, Basecamp). He is an incredible entrepreneur who built a multi-billion-dollar business; a project management software tool used by millions; and a skilled writer of insightful and engaging pieces with reflections from his own company-building experience. More of his tips on time management/risk assessment in the ‘Founder/Operator section below. What did he share that stood out to me?

On time-management, Jason quoted Warren Buffet’s approach to scheduling meetings, who apparently doesn’t set up appointments more than a day in advance.*

“So if you want to meet with him next Friday, you call on Thursday and say “Can I see Mr. Buffet tomorrow? I love the simplicity of the rule: I can see you today if you asked me yesterday, but I can’t fill up my schedule any further in advance. This way he can determine how he wants to spend his time within the context of the next 24 hours instead of booking things weeks or months in the future. Now his schedule is relevant instead of prescient.”

On decision-making, Jason stressed the importance of having the space to decide that whatever you do is worthwhile. Trying to have maximum control of your time while ensuring that what occupies your day matters. Those are two excellent pieces of advice that I hope will inspire you in the coming week!

Thank you for continuing to come back to ‘Ecosystem’**; and choosing this newsletter as your source of information on tech news and early stage fundraising! As always, really appreciate your comments and it is your feedback that helps drive the project forward! :)

“I find the depth and breadth of ‘Ecosystem’ incredibly helpful. I look forward to reading it each week!” - Alexandra Wyatt, Founder, Heroa

*I did look up Jason’s reference to Warren Buffett and found two of his essays on scheduling meetings here and here.

**If you want to find out more about the ‘Ecosystem’ project, what drove me to start it and my views on diversity and inclusion, take a listen to Blended’s newest episode, a brand new show by Let’s Talk Supply Chain, one of the most popular podcasts for anyone in supply chain/logistics tech.

See you next week! 👋

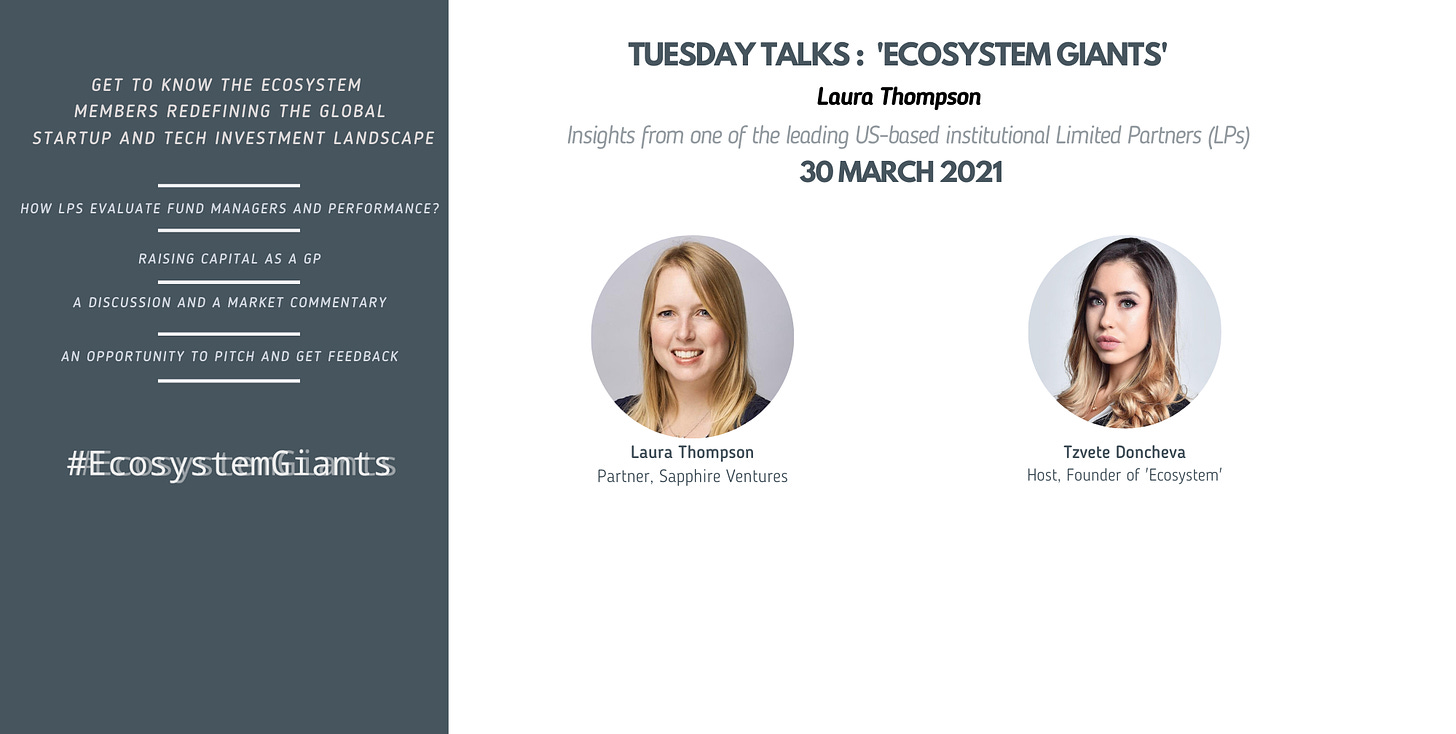

#EcosystemGiants

Where does the money behind the money in venture come from? If you are new to the VC ecosystem, it may come off as a surprise but VCs go out fundraising too. The capital to be allocated to founders comes from a fund’s limited partner(s); the investors in a VC firm. So how is a VC fund raised?

Find out this Tuesday, 30 March at 6pm CET (5pm GMT) from Laura Thompson (Partner, Sapphire Partners, the LP arm of Sapphire Ventures. Laura invests in technology-focused venture funds in the US and globally. She is passionate about partnering with established and emerging firms to advance the thinking in the limited partner space and a frequent contributor to OpenLP.com in an effort to help increase transparency across the venture ecosystem. Founded in 1996, Sapphire Ventures is a leading venture capital firm that partners with visionary teams and venture funds to build companies of consequence with over $5.7BN AUM. Sapphire Partners is the dedicated investment organization within Sapphire Ventures focused on investing in early-stage venture funds in the US, Europe and Israel and is committed to more than two dozen early-stage funds through which it holds interests in more than 1,500 companies globally.

It is an incredible honour to welcome Laura at #EcosystemGiants in a conversation about funding inclusive innovation, the state of the LP/VC ecosystem and investing in emerging and established fund managers! Join the discussion by signing up below.

Innovation Ecosystem Updates

Trending. Big Tech CEOs (Facebook, Google, Twitter) testified before US Congress to address the spread of misinformation on their platforms (CNBC). During the hearing, Twitter CEO Jack Dorsey got called out by a lawmaker for starting an online pool (good multitasking skills indeed!) via Techcrunch. On a similar note, Facebook and Amazon are now the two biggest corporate lobbying spenders in the US, as Big Tech eclipses former top lobbying spenders Big Oil and Big Tobacco (Public Citizen). Full report here. An insightful chart on the way 54 markets have performed since the March 2020 Covid lows (Bitcoin only takes second place with 782% change). Following a 81% revenue growth in 2020, robotic automation company UiPath files to go public (CNBC) and electric vehicle company Arrival becomes UK's biggest tech IPO with $13BN Nasdaq float (Yahoo Finance). One of Canada’s top investors (who launched OMERS Ventures!), John Ruffolo debuts a new $500M VC fund (Techcrunch).

Disposable camera app Dispo*** rocked by a rape allegation against a former associate of Co-Founder (and Youtuber) David Dobrik; Investor Spark Capital made the very rear move to ‘cut all ties’ with the company (Fortune). Consequently, David Dobrik also stepped down from the app (BBC).

***If you are a long-term reader of ‘Ecosystem’, you may remember coming across Dispo as a ‘Startup of the Week’ in Issue 21 (Nov ‘20). The company raised $20M at a $200M valuation in a round led by Spark Capital in February 2021.

And finally, what is it like dating a founder? Hats off to Amy Lewin for a very thoughtful piece celebrating the unsung heroes behind a successful startup (Sifted).

Massive rounds. One of the world’s largest cryptocurrency wallet providers, British Blockchain.com banks a megaround of $300M; and is valued at $5.2BN(CNBC). The cash injection comes just one month after the crypto start-up raised $120M at a $3BN valuation. Berlin-based on-demand grocery delivery startup Gorillas becomes the fastest unicorn in Europe, raising a whopping $290M series B, led by top VC firms Coatue Management, DST Global, Tencent, Fifth Wall; alongside early investor Atlantic Food Labs (Silicon Canals). What a journey in just ten months! Seen as the UK Robinhood alternative, stock trading platform Freetrade secures a $69M Series B round (Pitchbook). Across the Pond, after experiencing 600% YoY growth, remote online notarization platform Notarize gets $130M in fresh funding and accounting startup Pilot banks a $100M round (at a $1.2BN valuation) led by Amazon founder Jeff Bezos’ personal investment fund (CNBC). B2B crypto portfolio management software Lukka picks up $53M from Soros Fund and S&P (Ledger Insights).

Acquisitions. The £140M merger between British crowdfunding platforms Crowdcube and Seedrs is off; provisionally blocked by UK competition watchdog (City A.M.). Dutch ERP software firm Unit4 acquired by private equity firm TA Associates in a deal in excess of $2BN (Tech-EU). Virtual experience platform Hopin snaps up video hosting provider Streamable and video technology company Jamm (Business Wire). Tech giant Microsoft in advanced talks to acquire messaging platform Discord for $10BN+ (WSJ).

Sustainability. An extensive directory featuring the sustainability startups to watch in Europe in 2021(Sifted) and the top 15 of them according to VCs (Sifted). The latest must-have for America’s (tech) billionaires isn’t another mega yacht or space program – it’s a plan to end the climate crisis (Guardian). Clean tech 2.0: Silicon Valley’s new bet on start-ups fighting climate change (FT).

Wins for women. More capital for *female* founders - Co-Founders and Managing partners at BBG Ventures, Susan Lyne and Nisha Dua close their third fund at $50M (Forbes).👏 Contemporary artist Krista Kim designed and sold the first NFT house for $500K+ her thoughts on living in an AR lifestyle (CNBC). 👏Former Venture Partner at global venture fund and accelerator 500 Startups, Monique Woodard is building Cake Ventures, a VC firm with a thesis that ‘demographic changes are changing technology’ (Protocol). 👏

"Women-founded startups generate more revenue per Euro invested and outperform in capital productivity by 96%." Yet, progress in allocation of VC funding to female-led teams is flat in CEE region. Since 2016, all-women founding teams have received on average 2% of startup investment. Not exactly a win, but the ‘CEE funding landscape report through gender lens’ is a must-read that points to the difficulty faced by women entrepreneurs and women fund managers in accessing finance in Europe and what can we all do to tackle the issue of underrepresentation.

Funder

Kara Nortman (Managing Partner, Upfront Ventures) on being a good leader and qualities of a great board member

“Behavior is shaped by incentives. Nobody will say anything that could negatively affect the outcomes within their own portfolio. VCs will complain about the price of new investments, but they’ll be the first to justify the value of their existing portfolio companies. This is the nature of the game. It’s the elephant in the room. The ultimate result is that there are two camps that have emerged in the VC community: Those who completely believe in and are embracing the new world and those who are struggling to get there.”

Frank Rotman (Founding Partner, QED Investors) on what is going on in private/public markets, the state of VC and the two investing frameworks that emerged - must read!

“Have levels of reveals. Don't give it all up in the first meeting. Stick to a few (literally, just 3) main talking points, and keep the conversation light. The purpose of the 1st meeting is to get a 2nd meeting. If you did a great job selling and the person wants to go to the next step (yay!) or the person isn't a fit (totally fine), politely end the meeting early. Don't keep going once you've made the sell, and don't sink much more of your time if there isn't a fit there.”

Ariana Desiree Thacker (Founding Partner, Conscience VC) gives the 101 (25 practical points) on raising a first-time fund during a pandemic

Founder/Operator

Jason Fried (Founder and CEO, Basecamp) reflects back on the journey of building a $100BN dollar company, sharing tips on time management and decision-making

Kirsty Nathoo (CFO and Partner, Y Combinator) on growing Y Combinator from the very early days

Twitter Highlight(s)

Paige Finn Doherty, Developer Success Engineer, WorkOS

Liz Beechinor, President and Founder, Coefficient Marketing

Startup of the week

Bumble meets Spotify for the art world

Cohart is a female-led, AI-enabled mobile platform leveraging personalization algorithms to connect the next generation of creators and consumers. A place where creators and consumers match, build relationships, and can buy & sell directly (starting with ‘Art’ as a vertical). Founded by entrepreneurs with over three decades of relevant industry experience. Tweet @cohart_co to share they were featured in ‘Ecosystem’!

Do reach out to me if working on a product advancing one or more of the United Nations Sustainable Development Goals. I’m also particularly interested in the Creator Economy - and would love to hear from you if building something in the space.

Startup Go-to Resources

From the things to know before starting a company to marketing and fundraising - THE field guide for early stage founders by Unusual Ventures

5 ways to build a $100M business - an infographic by Point Nine Capital

You can't measure what you can't see - The startup guide to analytics

Why do you startup? A fantastic short essay by Ruby on Rails creator, David Heinemeier Hansson

The board meeting guide for SaaS startups How to prioritize your time by YC Partner Adora Cheung

The must-read guide to syndicates

Building a personal monopoly through writing online - an interview with Jack Butcher(Founder, Visualize Value)

50 Best Pitch Deck Examples from YC & 500 Startups

How should a bottom up company think about B2B pricing and packaging? via A16Z Thank you for reading another ‘Ecosystem’ newsletter! What feedback do you have for me (likes/dislikes)? I would greatly appreciate if you share this with contacts (founders, tech operators & investors) who may find the content helpful🖤 Connect with me on Twitter