Sight. 'Ecosystem' #31

A weekly guide on tech news and early stage fundraising. Aiming to open access to venture capital for less networked founders and junior VCs.

For access to all monthly events, archive or if you would like to support the project, become an annual subscriber⭐ New to ‘Ecosystem’? Find out what it is here.

Hello and welcome to issue #31!

The information you consume on a daily basis will determine how you think about and see the world. What you eat is who you are, and what you read is who you become.” - Polina Marinova Pompliano, Author and Founder, The Profile

Thank you for coming back and reading ‘Ecosystem’ for yet another week! I’ve said it before and I’ll say it again - truly appreciate you choosing to get your weekly news intake and to stay informed from this exact newsletter, out of the never-ending sea of content! In an effort to give back (and also help you discover fellow interesting members of the community), I’ll be regularly sharing reader testimonials.

“The 'Ecosystem’ is simply one of the most informative, inclusive and inspirational resources for VC professionals out there. I can't wait for the next one to arrive in my inbox knowing that it will give me a new idea to pursue. Thank you.” - Kiril Mintchev, Director London Chapter, CEO Angels Club

Last week’s issue was very female-focused (I am aware!) - and as such interested in finding out what the men reading it thought (if you would like to share feedback and haven’t already, do hit reply and let me know :)). My firm belief is that the only way change can happen is if men and women work together towards advancing progress in society - and are jointly committed to bringing up the number of women on investment teams and in the companies they back. We should shy away from ‘echo chambers’ where one group only hears their own views parroted back at them (credit to Judith Dada who I’ve learned this from). And I’m very pleased that despite the strong diversity narrative and the obvious female voice, well over 60% of the ‘Ecosystem’ community members are male :)

On top of this and gender aside, role models ultimately are inspiring individuals. Full stop. It is however human nature to like and identify with those who are most similar to us - and yes, that includes appearance too. Therefore, I’d like to highlight two male leaders (come back next week to find out who the second one is!), who I believe we can all learn from (and perhaps you’ve not heard of!).

Sahil Bloom is an investor and advisor and his threads demystifying business/finance have not only successfully made it through my online content consumption filter but have become pieces of information I check on a regular basis. Ever heard about the parable of the fisherman and the investment banker? A tale to help us all reflect on what’s important and the precious nature of time.

How would you spend your days if you never had to worry about money again? :) Another thread by Sahil I’d recommend is on time prioritization featuring The Eisenhower Decision Matrix*.

Enjoy the Sunday and until next week! 👋

“Time is the scarcest commodity. No matter who you are, you have twenty-four hours a day, and when you give time up you're giving up something important." - Warren Buffett, CEO, Berkshire Hathaway

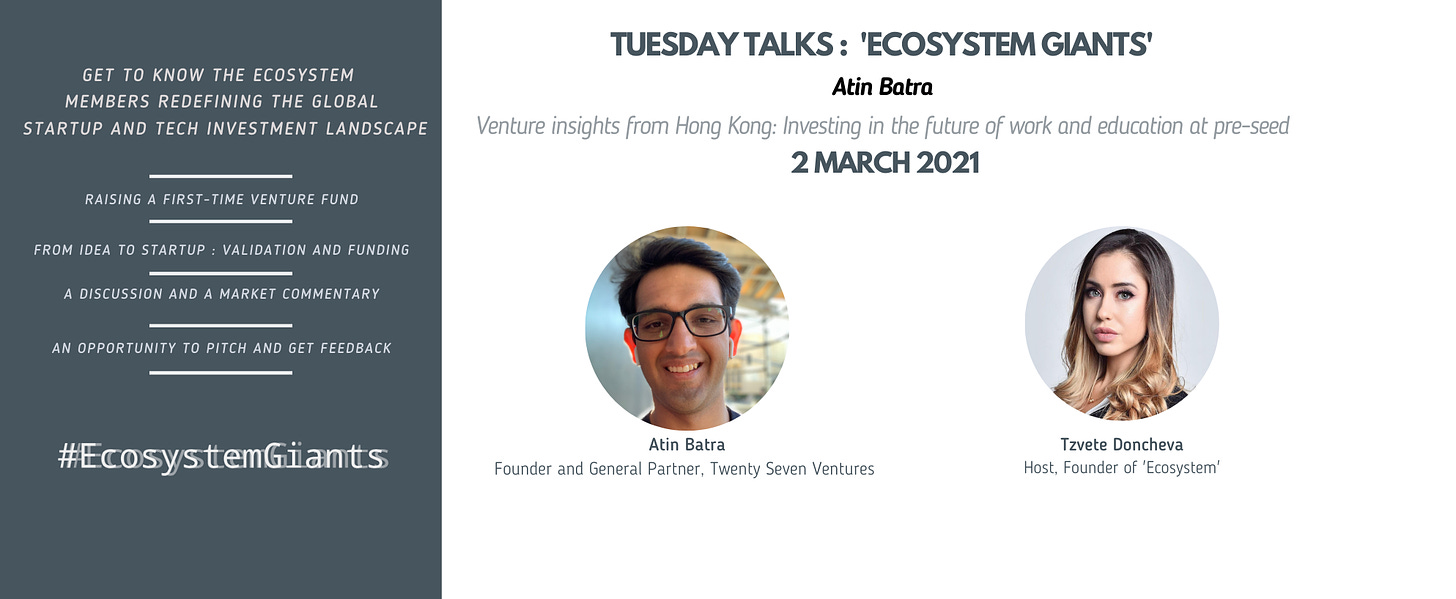

#EcosystemGiants

It is a great pleasure to welcome Atin Batra (Founder and General Partner, Twenty Seven Ventures) as the next #EcosystemGiants guest! Atin has extensive experience working with very early stage founders (has previously led Hong Kong’s first corporate accelerator), helping teams test and validate startup ideas and build initial traction. He is the Founder and solo GP at Twenty Seven Ventures, a VC fund based out of Hong Kong, investing globally (pre-Seed/Seed) in outstanding entrepreneurs building big businesses in the areas of EdTech and Future of Work.

The conversation will be about :

The pre-seed investment trends in Hong Kong and the state of the startup ecosystem

Learning from the successes and failures of the same business models in other markets - is it possible to lower the risk profile to fund/build a company in Asia?

Raising a first-time venture fund as a solo GP - what are LPs looking for in emerging managers in Hong Kong and the region?

Tune in at 11am GMT (12pm CET) on Tuesday 2 March 2021.

Supported by community partners:

Startups Magazine, ParlayMe, Kaiku, When Unicorns Fly

Innovation Ecosystem Updates

Whether you are an investor, a founder, an operator, a corporate or a friend. The top news stories this week you may find of interest.

Trending. Uber drivers win landmark UK judgement on workers benefits (Guardian). Google fires the second co-lead of its ethical AI team (The Verge). Barclays to close its mobile payments app Pingit this summer (Sifted). As cryptocurrency prices skyrocket, celebrities from Marc Cuban to Lindsay Lohan join the new crypto craze : creating rare digital collectibles (non-fungible tokens) that sell for millions (Vice). Clubhouse tops 8M global downloads in prelaunch, invite-only mode, growing by over 50% in the first half of February (Techcrunch). Is Europe catching up on the SPAC boom? Two announcements only this week: Klaus Hommels (Founder, Lakestar) launching a $332M SPAC (to list in Frankfurt on Monday 22 February) and Louis Vuitton-owner Bernard Arnault sponsoring a SPAC focused on European finance (Business Insider). German VC investor Earlybird VC announced a $242M fund to back early stage companies in ‘Emerging Europe’ (Techcrunch). Random fact: One of the four investments out of the new fund is in Bulgarian fintech Payhawk.

The top 13 cities in Europe’s tech scene and how can they collaborate better? 👇

Sustainability. More capital for purpose-driven companies. French investment firm Founders Future launches a new fund to invest in impact startups (Sifted). Revent Ventures, a new European impact VC firm, comes out of stealth with a stellar founding team and targeting a $60M fund (Sifted). Ari Helgason, formerly partner at Index Ventures to start a new VC firm, investing in revolutionary ventures addressing the ecological crisis. Joining him are his brother David Helgason (who’s also an investor and a founder at a now publicly listed company) and Benjamin Ratz (an investor and a lawyer by training). As Bitcoin surged to an all-time peak and hit a $1 trillion market cap; and the amount of energy it consumes is also on the rise (annually as much as the whole of Switzerland!). Could a green coin be the next big thing? (LiveMint). Our cities are sinking - why are they at risk of collapsing under their own weight and what does it have to do with climate change? (Euronews).

Acquisitions. Following a $690M raise from SoftBank in December to fuel acquisitions, cloud communications firm Sinch buys Inteliquent, the largest independent voice communications provider in the US for $1.14BN (Techcrunch). Log management software startup Humio acquired by cybersecurity firm Crowdstrike in a deal worth around $400M (Tech.eu).

Massive rounds. German travel startup GetYourGuide secures $97M revolving credit facility (Techcrunch). Chicago/Madrid-based software company Copado, raises nearly $100M (The Business Journal). Portugal-born low-code platform OutSystems, closes a $150M funding round at a $9.5BN valuation (Finextra). Out of the UK, London-based crypto wallet and exchange company Blockchain.com raises $120M (Reuters).

Wins for women. Norway's $1.3T sovereign wealth fund, one of the world's biggest investors, called for more diversity, especially gender equality, on the boards of the companies in which it invests (Yahoo News). 👏

"What we want to see is better representation of women on the boards.” - Carine Smith Ihenacho, Chief Governance and Compliance Officer, Norges Bank Investment Management

Female founders and Black founders land 30% of the largest US early stage rounds in 2021 (Crunchbase).👏 Ex-General Catalyst investor Addie Lerner and Tali Vogelstein, previously at Bessemer Venture Partners launch Avid Ventures, a $68M debut fund to invest in early stage founders in The US, Europe and Israel (Techcrunch).👏 Former A16Z partner and ‘Future of Work’ expert Li Jin launches Atelier, a $13M fund to support the ‘Passion Economy’. 👏 More about how she raised the fund (at the height of the pandemic), her investment criteria and vision for the ‘Future of Work’ here.

“Someone must always be challenging the status quo for progress to occur. Founders express this by starting their own company. Investors express this by funding those companies. I have this vision of the world where people should be able to do what they love for a living and earn an income by leveraging their unique skills, education, and creativity— rather than be forced to perform commoditized work. My model of accelerating that vision is to back those very companies.” - Li Jin, Founder, Atelier

Funder

Ashley Braiser (Partner, Lightspeed Venture Partners) shares tips on prototyping, acquiring/ understanding early customers and the importance of founder-market-fit in investment decisions

Andrew Wilkinson (Co-Founder, Tiny Capital) on finding/buying profitable businesses (the Buffett approach to collecting companies) and taking WeCommerce public in Canada

Founder/Operator

“Being part of a Corporation means that the signal to noise ratio changes dramatically. The amount of time and effort spent on Legal, Policy, Privacy - on features that have not shipped to users yet, meant a significant waste of resources and focus…I am not saying this is not important BUT this had zero value to our users.”

Noam Bardin (Founder and former CEO, Waze) reflects on the days as a startup CEO post-acquisition, Tech-Corp life and why he ultimately decided to leave Google

Elisheva Marcus (Marketing and Public Relations Manager, Earlybird Venture Capital) put together a framework with insights from experienced product managers to help you assess professional purpose and cultural fit when interviewing for a new role

“A growth framework should highlight the areas in which an individual contributor can progress and step up. This allows team members to see what their potential career paths could look like. It turns career conversations from ‘titles’ to ‘skill sets’ and ‘competencies’.”

Yenny Cheung (Engineering Manager, Rasa) gives advice on designing a growth framework that helps a company become more inclusive and brings out the best of a(n) (engineering) team

Twitter Highlight (s)

Christoph Janz, Managing Partner, Point Nine Capital

Startup of the week

Bookmarks that save you time

Joggo is a browser extension to help you save and organize content online - and consume it 10x faster! Make your ‘content corner/library’ (with favorite articles, podcasts, Tweets), share with your network or follow experts’ Playlists for more inspiration.

Try supercharging your content consumption by signing up through my link here ;) and tweet @JoggoHQ to share they were featured in ‘Ecosystem’!

I would love to hear from founders working on products/services that advance one or more of the United Nations Sustainable Development Goals. Are you building a purpose-driven startup I should know about?

Startup Go-to Resources

Eight Ways to go Viral - What do Facebook, LinkedIn and Youtube have in common? An insightful article by Uzi Shmilovici (CEO and founder, Future Simple) on building viral features to accelerate growth

Enterprise Playbook: Pricing: How to Build a Value-Based Calculator, a guide by Work-Bench From a $550k first raise to a $350M second raise?

Profitability from day one, a simple yet viral product - Tope Awotona on building Calendly

Turning 'Adjacent' users into engaged ones - an in-depth analysis by Bangaly Kaba (EIR at Reforge; Former VP Growth at Instacart & Instagram) inc examples for Slack and Instagram

What does data (30,000 data points to be exact!) reveal about billion-dollar startups? Pre-order the book by Ali Tamaseb or see the thread with insights

A visual communication planner : getting from idea to results

The features that can make or break a product - Whitney Wolfe Herd (Founder and CEO, Bumble) on Masters of Scale

The must-read guide for remote teams - frameworks on (a)synchronous meetings and more

How to develop an effective fundraising deck?

*More on the "Eisenhower Box" - how to be more productive and eliminate time wasting activities?

Thank you for reading another ‘Ecosystem’ newsletter! What feedback do you have for me (likes/dislikes)? I would greatly appreciate if you share this with contacts (founders, tech operators & investors) who may find the content helpful🖤 Connect with me on Twitter