Bold. 'Ecosystem' #38

A weekly guide on tech news and early stage fundraising. Aiming to open access to the venture industry for less networked founders and junior VCs.

For access to all monthly events, archive or if you would like to support the project, become an annual subscriber⭐ New to ‘Ecosystem’? Find out what it is here.

Hello and welcome back to ‘Ecosystem’, issue #38!

In this newsletter, you will learn:

Top tips on prioritization and leadership from Checkout.com’s Guillaume Pousaz (who raised $830M at a $15BNValuation)

Who the 23rd female founder to take her company public in the US may be

How to find the earliest backers for your startup or begin your angel investing career from unicorn angel investor - find the details about the next #EcosystemGiants session below

What the 10 most common mistakes first-time SaaS founders make are

Thank you for coming back to ‘Ecosystem’ and continuously choosing this newsletter as your source of information on tech news and early-stage fundraising! 💗

Remember you don't get what you don't ask for - be bold as you are working on hitting your goals next week! See you on Sunday! 👋

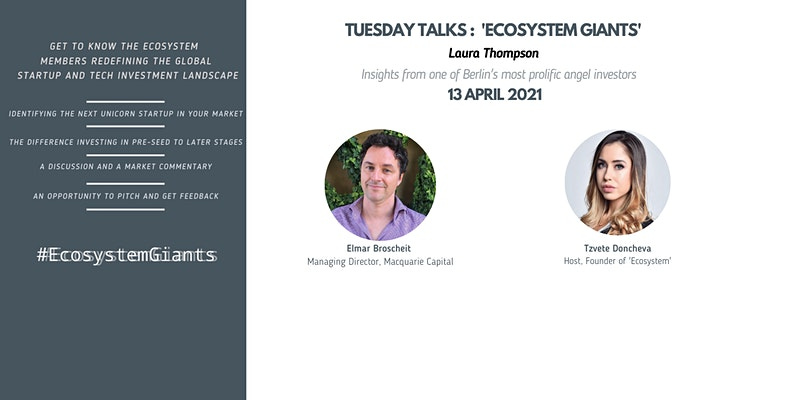

#EcosystemGiants

While talent is equally distributed, opportunity is not - tackling the issue of access to opportunity in early-stage fundraising has indeed been a key driver behind starting the 'Ecosystem' project. As a founder, how do you find the very first backers for your startup : the angel investors, who may be willing to take a bet on you long before an institutional investor does. And if you are an angel investor, how to go about identifying the next trillion-dollar opportunity and assessing potential investments?

It is an honour to welcome Elmar Broscheit (Managing Director, Macquarie Capital and unicorn angel investor) in a conversation about angel/venture investing and spotting billion-dollar businesses early on Tuesday, 13 April at 7pm CET (6pm BST). Elmar has been working in VC at Macquarie in Australia, Asia and Europe for over 10 years and among other things was involved in Macquarie's investments in Lieferando (exit to Takeaway.com), Takeaway.com (exit through IPO), Ganji (exit to Tiger Global), JobsDB (exit to Seek), Nuix and Stocard. He is an angel investor in German unicorns Tier Mobility and Gorillas.

Supported by community partners: Startups Magazine, ParlayMe, Kaiku

Have you missed on the previous #EcosystemGiants sessions? Read the highlights from the chats with Laura Thompson (Partner, Sapphire Partners, the LP arm of Sapphire Ventures) and Atin Batra (Founder and GP, Twenty Seven Ventures)

Innovation Ecosystem Updates

Trending. Leading global VC firm Index Ventures launches Index Origin, a new $200M dedicated seed investing vehicle (Techcrunch). Five IPOs scheduled to raise $4.5BN in the week ahead, joined by Coinbase’s much awaited direct listing (Renaissance Capital). Brace yourself for some IB news. In an era of prosperity for investment banks, Credit Suisse is navigating from one crisis to another. After a series of costly errors (inc a $4.7BN writedown tied to the Archegos blowout), what is next for the firm (Bloomberg)? The fast rise and even faster fall of a trader who bet big with borrowed money - how Archegos’ Bill Hwang made $20BN, and lost it all in two days when his investment fund imploded (Business Insider). Plus see JPMorgan CEO Jamie Dimon’s annual letter to shareholders (22 pages (!) on rebuilding America and addressing the world’s biggest problems including climate change, poverty and racial inequality). As NFT prices slump 70% (The Art Newspaper), has the format for collecting digital art seen a bubble burst already? (Observer). Innovation in preventive medicine - a clinic to reverse aging opens in Dubai (first in that region, second in the world) via Gulf News. And why London will remain ‘El Dorado’ (FT).

Massive rounds. Digital mortgage lender Better.com gets $500M from Softbank at a ~ $6BN valuation (CNBC). German fintech Auxmoney nabs fresh ~$298M in funding (Global Capital). Norwegian online grocery startup Kolonial raises $265M on a $900M valuation, in a round co-led by Softbank and South Africa’s Naspers tech holdings, Prosus; rebranding itself to Oda and continues to expand in Europe (Techcrunch). UK-based Fintech platform TrueLayer banks $70M in Series D funding in a move to build an open banking network (Techcrunch). Barely eight months after its last cash injection, enterprise AI-based no-code platform BRYTER bags a rather large series B round of $66M in a move to accelerate US expansion (GlobeNewswire).

Acquisitions. Corporate catering company Elior buys French food delivery startup Nestor for an undisclosed amount (Techcrunch). Big Tech company Google acquired Dysonics, a startup focused on 3D audio tech a few months back - and never made a formal announcement (Protocol). Another tech giant, Twitter reportedly in acquisition talks with audio app Clubhouse on potential $4B deal (Techcrunch). PAR Technology Corporation snaps loyalty provider Punchh for $500M in a move to become a unified commerce cloud platform for enterprise restaurants (BusinessWire).

Sustainability. With life becoming increasingly digital, the demand for semiconductors is surging (chips are key components of applications from washing machines to AI) - and there is a giant carbon footprint to match (Bloomberg). Have we gotten carbon capture, viewed by many as the ‘last resort’ set of tools in the decarbonization toolkit, wrong? (Wired) European food techs raised another $3.2BN in funding in 2020; with much of the investment driven by the alternative protein sector (DigitalFoodLab report). Is your startup working to address climate change and/or social inequality? Apply by 16 April 2021 to join the 10th Cohort of Elemental Accelerator and a chance to get $200K-$500K in funding (open to companies worldwide). And more opportunities for impact startups to get funded - French VC firm Ring Capital closed a €35M fund, targeted at environmentally - and socially-focused companies; with tickets between €500k-€5M (FrenchWeb). From Bulgaria to Singapore, a selection (and analyses) of 8 businesses addressing a range of UNSDGs.

Impact startups currently fundraising can apply to be featured in the next SIC newsletter; impact investors - can sign up here if looking to diversify the dealflow pipeline or reach out to me directly to find out more.

Wins for women. Jessica Alba set to become the 23rd woman to take a business public after her consumer goods company Honest files for IPO (CNBC). 👏 Tekedra Mawakana becomes the co-CEO at billion-dollar autonomous driving Waymo (the self-driving unit of Alphabet). 👏 Canva Co-Founder Melanie Perkins among the top 10 wealthiest Australians after the company’s latest $71M raise; which turned it into a decacorn (The Australian Financial Review).👏Two amazing ladies awarded for their achievements in the startup ecosystem by 500 Startups (2021 Unity and Inclusion Awards) - Lolita Taub (Co-Founder and GP, The Community Fund) as ‘Founder advocate’ and Angel Gambino (CEO, Alchemists Collective and Partner at Prehype) as ‘Emerging manager of the year’. 👏 Female Founders Fund’s annual review of funding shows COVID pullbacks in 2020 were balanced by growth in digital health & social networks for women-led businesses. Plus a practical guide for business leaders to combat burnout concerns following the strain the COVID 19 pandemic has put on women (Sounding Board).

Funder

“A driving force behind many investments today, the founder and their story is what most of our experts look at first — so telling your story effectively is key.”

8 VC investors inc Nicole Quinn (Partner, Lightspeed) and Anu Duggal (Founding Partner, Female Founders Fund) summarize what they look for when assessing early stage businesses

What does it take to raise capital, in B2B marketplaces, in 2021? Julia Morrongiello (Investor, Point Nine Capital) shares the P9 findings based on investments in 9 B2B marketplace companies and data from 20+ different investors

Founder

“We beta launched at 1 school: University of Western Ontario (Canadian school) Why? - If you screw up in Canada, no one pays attention - If you screw up at NYU, everyone pays attention Tip: places like New Zealand, Canada, Australia are great places to launch your app.”

How Greg Isenberg (Co-Founder/CEO, Late Checkout) nearly lost everything building and selling his last company to WeWork

Guillaume Pousaz (Founder and CEO, Checkout.com) on balancing family life/running a billion-dollar business, prioritization tips as a leader (ie an email filtering system - urgent (to be done within an hour); end of the day/end of the week) and building a great team culture while rapidly hiring

Twitter Highlight (s)

Emma Ruth Phillips, Partner, LoalGlobe

Gil Dibner, General Partner and Founder, Angular Ventures

Startup of the week

The private chef at home service

YHANGRY is an at-home dining platform that lets you instantly book a made-to-measure dinner party (from as little as £100!). The female-led startup makes private chef experiences more accessible and affordable and has recieved backing from notable angels like Eileen Burbidge (Partner, Passion Capital), Carmen Rico (Partner, Blossom Capital) and Deepali Nangia (Co-Founder, Alma Angels).

Twee @YhangryChef to share they were featured in ‘Ecosystem’!

Do reach out to me if working on a product advancing one or more of the United Nations Sustainable Development Goals.

Startup Go-to Resources

From the things to know before starting a company to marketing and fundraising - THE field guide for early stage founders by Unusual Ventures

Top 10 mistakes first-time SaaS founders make - and how to avoid them

5 ways to build a $100M business - an infographic by Point Nine Capital

Why do you startup? A fantastic short essay by Ruby on Rails creator, David Heinemeier Hansson

The must-read guide to syndicates

50 Best Pitch Deck Examples from YC & 500 Startups

How should a bottom up company think about B2B pricing and packaging? via A16Z

The perfect series A deck - a template by Creandum

All about valuations

Not all startups become unicorns. Sahil Lavingia (Founder and CEO, Gumroad) on the failure to build a billion-dollar companyThank you for reading another ‘Ecosystem’ newsletter! What feedback do you have for me (likes/dislikes)? I would greatly appreciate if you share this with contacts (founders, tech operators & investors) who may find the content helpful🖤 Connect with me on Twitter