Vulnerability. 'Ecosystem' #42

A weekly guide on tech news and early stage fundraising. Aiming to open access to the venture industry for less networked founders and junior VCs.

For access to all monthly events, archive or if you would like to support the project, become an annual subscriber⭐ New to ‘Ecosystem’? Find out what it is here.

Hello and welcome back to ‘Ecosystem’, issue 42!

In this newsletter, you will learn:

What led to the global chip shortage - and why is it important?

Which actress turned founder took her company public this week?

How to structure an effective (internal/external) communications framework?

What is the difference between a good and a great retention?

If you’ve been following the ‘Ecosystem’ newsletter, you know about my deep interest in human psychology/neuroscience - understanding why we (as people) behave the way we do. One of my favorite researchers in the field is Brené Brown - this week I found out she launched her own podcast - and the latest episode is with no other than Oprah Winfrey (and Dr Bruce D. Perry); a conversation about resilience. Very timely as we are re-emerging in a new post-Covid version of normality. If you do take a listen, let me know your thoughts.

Thank you for coming back to ‘Ecosystem’ for yet another week and for choosing it as your read on tech news and early-stage fundraising! If you want to see the project grow, you may support it further here. See you next time! ☀️

#EcosystemGiants

‘How to break into VC?’ is a question that would never get old and is continuously being asked - which is normal as there is far more demand for venture capital jobs than there is supply. When you are coming straight out of university, are without industry experience and network; it can be a near impossible challenge. The next #EcosystemGiants guest not only successfully broke into VC but built a very strong personal brand and community following - in a matter of months (and well before turning 24!). She has also become a true thought leader on all ‘Gen Z VC’ topics; coining the term in her first ever article (which featured insights from 70+ young investors on the trends they’re watching!) and shortly after starting the Gen Z VCs Slack community (which now counts 7,000+ members!). It is very exciting to have the opportunity to welcome Meagan Loyst (VC, Lerer Hippeau) at #EcosystemGiants at 7pm CET (6pm BST) on Tuesday, 11 May 2021!

A conversation about :

Breaking into VC

Building a personal brand as an investor

The consumer trends Meagan (and other Gen Z VCs!) follow in the areas of EdTech, The Creator Economy and more

Supported by community partners:

FemGems, ParlayMe, Startups Magazine

Have you missed out on the previous #EcosystemGiants sessions? Read the highlights from the chats with Soraya Darabi (Co-Founder and GP, TMV), Elmar Broscheit (Managing Director, Macquarie Capital and angel investor), Laura Thompson (Partner, Sapphire Partners, the LP arm of Sapphire Ventures) and Atin Batra (Founder and GP, Twenty Seven Ventures)

Innovation Ecosystem Updates

Trending. Meme-inspired cryptocurrency Dogecoin overtook SpaceX in overall market value, after doubling in price over the last week (The Independent). That is of course before Elon Musk called it a 'hustle' during his guest-host spot on "Saturday Night Live"; a joke that led to the digital coin losing over a third of its value in the morning hours of Sunday (09/05) via Reuters. As previously mentioned (in issue #38!), there is a global shortage of semiconductor chips; which has gradually become worse (CNBC) and has now thrown entire industries into chaos (Telegraph). A further explanation of the problem, driven by the bumpy consumer demand (ever heard of the Bullwhip Effect?) and future outlook via Quartz. Home fitness startup Peloton is recalling up to 125K of its treadmills over safety concerns after the death of a child and dozens of reported injuries - and is ceasing to take new orders (The Guardian). The move will likely cost the company over $165M in lost revenue (FT). And while VC as an asset class is performing better than ever (and 2020 was a record year for venture fundraising!), why are then so few first-time funds being raised? (Pitchbook)

Massive rounds. Canadian online commission-free retail investment platform (Robinhood lookalike?) Wealthsimple snaps a whopping $610M in funding at a valuation of about $4BN (Bloomberg). The round is led by Meritech Capital Partners and Greylock Partners, with celebrities like Drake and Ryan Reynolds also participating. A new European unicorn! French insurance AI provider Shift Technology raises $220M in a Series D round, valued at $1BN+ (Tech.eu). Swedish electric autonomous truck company Einride raises a $110M Series B round with participation from top investors Temasek, Northzone, Maersk Growth (Sifted). NY-based marketplace for architectural, design and construction materials Material Bank (founded by iconic media entrepreneur Adam Sandow!) secures $100M in Series C funding (Forbes). London-based bespoke nutrition startup Zoe tops up its Series B with $20M, bringing the total raised to $53M (led by Ahren Innovation Capital with NFL players also entering the round) via Techcrunch. Following up on the digital art hype, California startup Bitski bags $19M to become ‘Shopify for NFTs’ in a Series A round led by A16Z (Techcrunch).

Acquisitions. US on-demand delivery unicorn GoPuff snaps up UK-based grocery essentials platform Fancy and moves to expand internationally (Business Cloud). Norwegian EdTech company Kahoot buys Clever, one of the most widely-used digital learning platforms by U.S. K-12 schools for $500M; eyeing US expansion (Techcrunch). Following Apple privacy changes, mobile game publisher Zynga to acquire ad monetization platform Chartboost for $250M in cash (VentureBeat).

Sustainability. Dutch early stage investor Rockstart closes €22M for its agrifood fund; backing agritech and foodtech ventures up to series B (Pitchbook). In a move towards circular fashion, UK retail giant Asda starts selling second-hand clothes (BBC). Why is it a big deal? EVs specifically for ride-hailing? Uber and Arrival partner to produce electric taxis by 2023 (The Guardian). Why is sustainability becoming the #1 topic in society, economy and investing? Tune in at 7pm CET on 20 May for the pilot edition of Shaper Impact Capital’s ‘SIC Impact Insights’ to hear from Lisa Liu (Investment Associate, UVC Partners). PS you should also check out her B2B Sustainability Startup Landscape article, mapping ~150 companies that enable corporates to drive their sustainability agenda.

Wins for women. Another women-led business went public this week! Big Congrats to Jessica Alba for a very successful IPO (shares rose 44% in first day of trading!) of consumer goods company Honest (now valued at ~$2.7BN!) via CNBC. 👏 Despite her celebrity status and strong network, the road was anything but easy - Forbes has more here and Jeremy Liew (Partner, Lightspeed Venture Partners) reflects on the journey since the firm led its Series A here. )

Well done to Claire Díaz-Ortiz (Partner, Magma Partners) for taking a bold step to normalize the conversation around pregnant founders (and for giving a new meaning to the term #valueaddinvestor!); by creating the ‘Pregnancy doesn't have to be a PR crisis!’ campaign - supported by tech leaders like Antler’s Magnus Grimeland and Away’s Jen Rubio. More background on the initiative here. 👏

Funder

“The key concept is to really think more through what you share. It’s not about over-sharing, it’s not about simply journaling what’s happened in a time-interval, but rather the (p)PPP is a useful tool to help you organize what you’ve identified and assessed as important, and prioritized for maximal impact, and lastly, to keep you (and those around you) honest, on a weekly (or other time interval) basis, on how it’s really coming along.”

Carlos E. Espinal (Managing Partner, Seedcamp)’s framework for internal and external comms (Plans, Problems, and Progress) that founders (and not only!) can adopt - and the steps to take to get clarity/alignment from the entire team

Corinne Riley (Investor, Greylock Partners) shares more about the opportunities she’s seeing in the customer-facing side of B2B SaaS, what companies can do to make the customer experience loop more agile and the challenges she’s looking to tackle through tech investing

Founder/Operator

“I kept my head down and allowed people to tell me that I wasn't good enough at my job. As a mother, I would never want my daughter, who is now 11, to go through that…We have the opportunity to work together across our different communities to tell our stories, use our resources, and create change. If we want to leave a better world for our children, every one of us is responsible.”

Vicky Tsai (Founder, Tatcha) opens up about overcoming biases throughout her entrepreneurial journey, exiting her company in a $500M sale to Unilever and returning back to drive the business she once created forward

Marcos Galperin (Founder and CEO, MercadoLibre) on building one of LATAM's most successful businesses of the last twenty years ($72BN market cap!); his involvement in day-to-day company decision-making and tips on time management

Twitter Highlight(s)

Romeen Sheth (President, Metasys Technologies)

Jelena Jansson (Founder, Chunkie)

Startup of the week

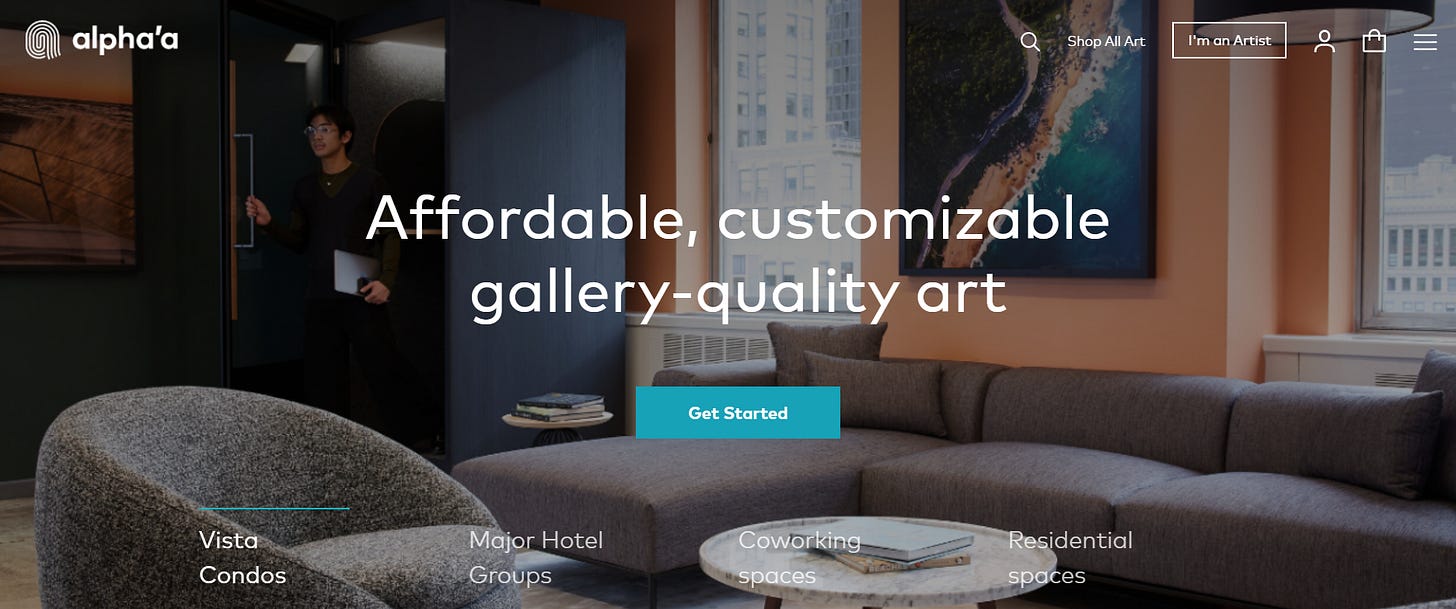

An ‘NFT’ alternative making visual arts accessible worldwide

Alpha’a is a community-oriented platform that connects artists to art collectors globally. The female-led startup features a crowdsource-driven approach to finding new, unique art (from photography to traditional paintings!) with users voting on works that will become available for purchase. Similar to NFT, the company uses blockchain to authenticate ownership and provide a transactional history on the artwork - but without compromising on environmental sustainability (as unlike Ethereum, the protocol it runs on uses a lot less energy in the process!).

Do reach out to me if working on a product advancing one or more of the United Nations Sustainable Development Goals.

Startup Go-to Resources

Navigating the PMF journey - a mental framework as described by Bessemer Venture Partners' Adam Fisher

How investors use growth ideas to evaluate startups? A must-read resource by A16Z's Andrew Chen (that helped him land the role at the firm!)

Negotiating a term sheet? The most common clauses, provisions and patterns found in a 2020 analysis of 94 VC final Seed, Series A and Series B term sheets by PwC Raise + The ultimate guide to term sheets at seed by ByFounders (re-shared!)

The MVP framework - measuring and proving user retention

The difference between a good and a great retention

Creating effective slide headlines for your deck - a guide by Hustle Fund Co-Founder, Eric Bahn

What is a pre-seed round and how to raise one?

Questions to ask yourself when stuck

The Three Rules of Freemium by Christoph Janz (Co-Founder and Partner, Point Nine Capital)

All about PR - a launch checklist and the 10 rules of media relations to follow as a founder - as advised by Lightspeed Venture Partners

Top 10 mistakes first-time SaaS founders make - and how to avoid them

50 Best Pitch Deck Examples from YC & 500 Startups Thank you for reading another ‘Ecosystem’ newsletter! What feedback do you have for me (likes/dislikes)? I would greatly appreciate if you share this with contacts (founders, tech operators & investors) who may find the content helpful🖤 Connect with me on Twitter